Check out our most Popular Searches

Choose The Product You Are Applying For

A Business Loan serves as an essential source of funds supporting the operation, expansion and growth of the venture. As an entrepreneur, you get to explore various types of Business Loan in India when in need of money. These variants of Business Loan cater to your specific financial requirements, helping you make the most out of your credit. Read along to learn about these credit types and their features in detail.

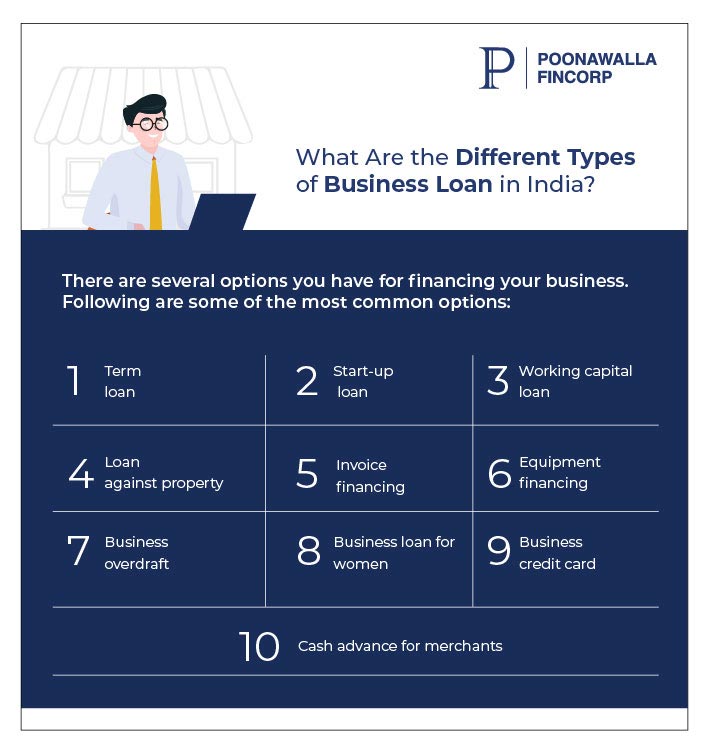

Several variants of a Business Loan are available in the market. Here’s a list of the top 10 types of Business Loan with their unique advantages and disadvantages:

One of India's most common types of Business Loan that leading lenders offer is a term loan. The loan amount sanctioned depends on the credit history of the business. Generally, the loan tenure for a term loan is anywhere between 12 months and 60 months.

Pros:

Cons:

Also Read: Understanding Term Loans: A Detailed Guide

Enterprises use working capital loans to overcome any kind of financial crunch and meet daily business requirements. The end use of this type of Business Loan can be for managing business cash flow, paying salaries, increasing inventory, purchasing raw materials, investing in machinery/equipment, etc.

Pros:

Cons:

Also Read: Boosting Operational Efficiency with Working Capital Finance

When your business requires a large principal, say a sum of more than Rs. 50 Lakh, you can opt for a Loan Against Property. The borrowers of this type of Business Loan must offer a property as security. Also, the repayment tenures range between 120 months and 240 months.

Pros:

Cons:

Invoice financing is suitable for small businesses. When companies face a lag between raising invoices and receiving payments, the Business Loan helps in meeting regular financial requirements. Here, the lender provides funds against the amount raised in the invoice.

Pros:

Cons:

Most manufacturing units require costly equipment for operations. Thus, one of the best types of Business Loan in India for manufacturing businesses is equipment financing or machinery loan.

Pros:

Cons:

A business overdraft is a great way to avail quick financing when your venture holds fixed deposits with a particular lender. To approve this loan, the bank or NBFC considers your business’ repayment history, cash flow, fixed deposit terms, and other factors.

Pros:

Cons:

Some banks and lenders offer a separate financing scheme for women entrepreneurs. The objective is to encourage women who are launching small to medium-sized businesses.

Pros:

Cons:

Also Read: 6 Best Business Loan Schemes for Women Entrepreneurs in India

To fulfil short-term requirements, a business credit card is excellent. It lets businesses obtain cash when they are in dire need.

Pros:

Cons:

With a merchant cash advance, you can obtain an advance of capital on the daily sales of debit and credit cards. The borrower needs to return the advance with a part of the daily credit sales.

Pros:

Cons:

When you have a proven track record of running a successful business, obtaining a Business Loan becomes easier. Lenders are confident in your ability to manage your business effectively and repay the loan on time.

So, if you have been running a business for a significant amount of time, the following are the Business Loan types that are most suitable for you:

1. Term Loan

If you are looking for a Small Business Loan, Term Loan can be the most suitable option for you. A Term Loan provides you with the necessary funds to meet your business requirements. These loans come with higher loan amounts and longer repayment tenures. Also, they are provided at competitive interest rates.

2. Line of Credit

A line of credit is a popular type of Business Loan offered by financial institutions. This loan option is preferable in the case of an emergency since it provides you with a credit limit that you can access as needed. Like a business credit card, you can withdraw funds and only pay interest on the amount used.

From Poonawalla Fincorp, you may apply for a Business Loan by following these steps:

It is always prudent to conduct a detailed study on various types of Business Loan in India before selecting the right one for you. By doing this, you can avail financing that is tailored to your business’ profile and requirements. Explore various Business Loan types at competitive rates from Poonawalla Fincorp and take your venture to greater heights!

A Cash Credit Facility is a type of short-term loan provided by financial institutions to businesses, allowing them to borrow funds up to a predetermined limit based on their creditworthiness. It provides flexibility for businesses to withdraw and repay funds as per their cash flow needs, making it a convenient source of working capital.

A Bank Guarantee is a financial instrument issued by a bank on behalf of a customer, promising to cover the financial obligations of the customer to a third party if they fail to fulfil their contractual obligations.

MSME loans are offered to owners of micro, small and medium-sized enterprises. Selected lenders offers these loans both via online and offline to help business owners avail funds of up to Rs. 50 Lakh.

We take utmost care to provide information based on internal data and reliable sources. However, this article and associated web pages provide generic information for reference purposes only. Readers must make an informed decision by reviewing the products offered and the terms and conditions. Business Loan disbursal is at the sole discretion of Poonawalla Fincorp.

*Terms and Conditions apply