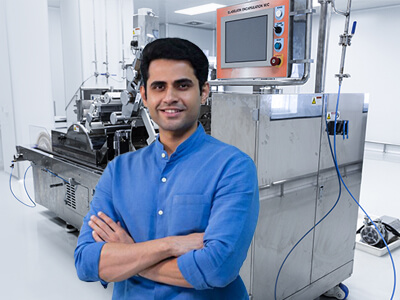

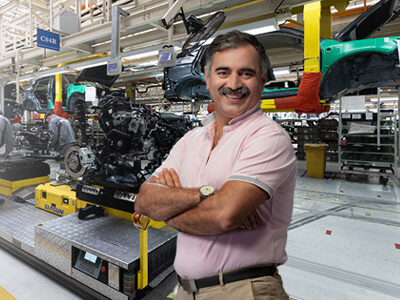

Empowering MSMEs with Specialized Machinery Loans!

In the dynamic business landscape, MSMEs contribute majorly to our economy growth by generating employment. But to keep thriving, MSMEs need latest and advanced machinery. With Poonawalla Fincorp’s Machinery Loan for MSMEs, enterprises can acquire the right machinery to boost their productivity and employment. Machinery Loan for MSMEs provides a financial boost at the right time without hampering the current finances. It allows enterprises to plan better while assessing the latest trends and demands. MSME Loan ensures enterprises have access to the necessary machineries without financial stress, supporting their journey to success in a competitive business world.

EMI Calculator for Online Machinery Loan for MSME

-

EMI Amount = *

Machinery Loan Interest Rate & Charges for MSME

With Poonawalla Fincorp, competitive interest rate for Machinery Loan starts at just 9.99% per annum, making them appealing to all the businesses. Please see below for more details:

| Interest Rates for Machinery Loan MSME | 9.99%* p.a. onwards |

| Loan Amount | ₹5 Lakh to ₹5 Crore |

| Loan Processing Fees | Up to 1% plus applicable taxes |

| Lowest EMI per month | Starting from ₹2,124* per Lakh for 60 months |

| Loan Tenure | 12 – 60 months |

| Prepayment/Foreclosure Charges | 0%* If paid from own sources & 4% If paid from other sources |

| Default Charges | 24% per annum |

| Cheque Bounce Charges | ₹500 per bounce plus applicable taxes |

| Stamp Duty | At actuals (as per state) |

| No Other Hidden Charges | |

Eligibility Criteria & Documents for Online MSME Equipment Loan

Minimum CIBIL Score

Nationality

Age

- Minimum CIBIL Score - A minimum CIBIL score of 650 or higher is required to be eligible for the MSME Equipment Loan.

- Nationality - The applicant should hold Indian citizenship.

- Age - The applicant must be between 24 and 65 years old when applying for the loan.

Documents Required for Machinery Loan for MSME

-

Income Proof

-

Business Proof

-

Identity Proof

-

Address Proof

- Income Proof: Documents showing your income, such as bank statements, salary slips, or income tax returns for self-employed individuals.

- Business Proof: Relevant documents showcasing the existence and nature of your business.

- Identity Proof: Any valid government-issued photo ID (e.g., PAN Card, Aadhaar Card, Passport, Driving Licence, Voter ID).

- Address Proof: Proof of your current residential address (e.g., utility bills, rental agreement).

Major Benefits of Poonawalla Fincorp Machinery Loan

Poonawalla Fincorp's Machinery Loan offers a range of significant advantages that cater to the unique needs of businesses. Here are the major benefits of choosing Poonawalla Fincorp for your machinery financing:

- Higher Loan Amount: Poonawalla Fincorp provides the opportunity to secure a Machinery Loan of up to 5 Crore. This substantial loan amount ensures you have the capital required for your machinery investment.

- Competitive Interest Rates: The company offers competitive interest rates, allowing you to access financing at favourable terms, which can ultimately save your business money.

- Flexible Tenure: With a tenure of up to 60 months, Poonawalla Fincorp offers repayment flexibility, enabling you to choose a tenure that aligns with your business's cash flow and long-term plans.

- Loan to Value (LTV) Up to 80%: Poonawalla Fincorp's Machinery Loan offers an LTV of up to 80% of the invoice value of the machinery. This means you can secure a significant portion of the machinery cost through the loan.

- Transparency: The company is committed to transparency in its dealings. There are no hidden charges, ensuring that you have a clear understanding of the loan terms and costs associated with your financing.

How to Apply for a Machinery Loan within 5 Minutes?

Apply

Online

Apply Online

Click on Apply Online and fill in the application form

Submit

Documents

Submit Documents

Provide your basic details

Verification

Verification

Your application will be processed and sent for basic verification

Quick

Approval

Quick Approval

Get your loan approved quickly

Instant

Disbursed

Instant Disbursed

Your applied loan is ready for disbursal. Our representative will help you with post approval formalities.

FAQs About Machinery Loan For MSME

An MSME Machinery Loan is specifically designed to help Micro, Small, and Medium Enterprises finance the purchase or upgrade of machinery and equipment. It differs from a regular business loan as it focuses on the machinery aspect, offering specialised terms and conditions.

*Terms & Conditions Apply