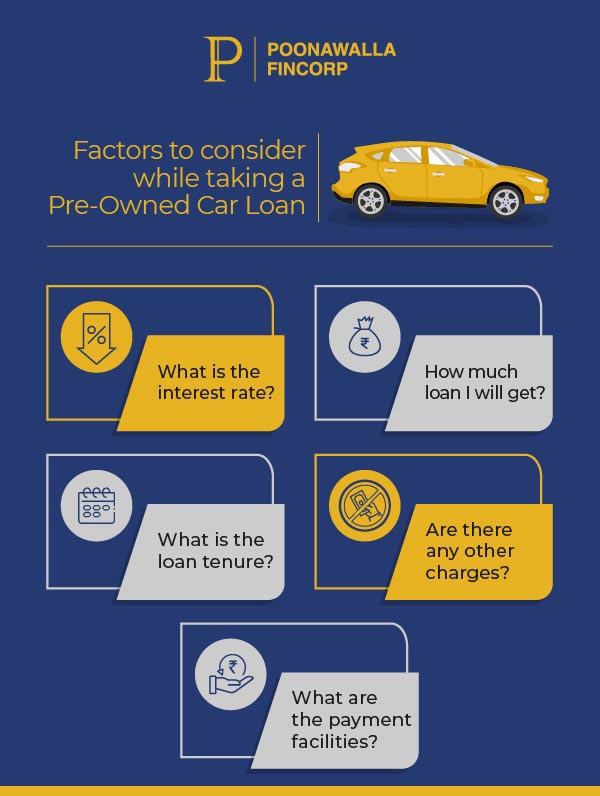

Purchasing a car is a big decision that brings with it many questions, even if it's a pre-owned or used car. Which car model should one buy? Which car will be ideal for the family? And the major one is – should one use their savings or take a loan? Loan is a popular choice for buying a new car, however before taking a loan one needs to take an informed decision.

Here are some factors to consider about used car loan.

Used Car Loan Interest Rates: Interest Rate is one of the important factors to be considered while taking a used car loan. It decides the EMI that a borrower will have to pay over the loan tenure. Taking loan for buying a car is always better as compared to using your savings. Paying fixed smaller amounts as EMI spread across a few years is always less strenuous than exhausting a lump sum amount from your savings. Also check your credit score before applying for the loan, as having a good credit score leads to lower interest rates.

Special offers on loans: In today’s competitive market, the customer is king. Financial institutions offer lucrative offers to attract customers. These Used Car Loan offers can provide great savings whether in the form of a lower interest rate or more convenient and flexible repayment options, and a great experience when offered as pre-approved loans.

How much down payment is required?: Used Car Loans that come with low or zero down payments, help you get your very own car without spending a large amount at once during purchase. This facility does not block your money in down payments and helps you pay for your car in smaller payments over a fixed period of tenure decided by you. A lower down payment amount also helps you choose a car of a higher segment, without any financial worries.

Which one is better: Used Car Loan or a Personal Loan?: Yes, you can buy a pre-owned car by taking either a Personal Loan or a Used Car Loan. With the later, the loan is secured by your car as collateral, and hence the eligibility criteria to get a used car loan are simple and flexible, as compared to personal loans. Also as it is a secured loan it comes at a lower interest rate than a personal loan, based on the customer’s credentials.

Save your savings: The decision of financing the car largely depends on how much money you have saved. And remember, your savings are crucial at the time of emergency or any unpredictable needs. So take a moment and think. If paying in cash will drain your savings, then it is best to take a car loan. Some lenders offer loans upto 100% LTV for used cars; you can also compare and check Poonawalla Fincorp’s Used Car Loan offerings.

Go for pocket friendly EMI: Interest rates and loan tenure are co-related to the EMI against your loan amount. Lower interest and higher tenure can bring you lower and pocket friendly EMIs. Checking your EMI affordability will help you pay your EMIs on time without any delay or default. Once you are sure about the affordability, select the tenure accordingly. You should preferably go for a shorter tenure, as that will reduce the interest outflow over the loan tenure.

Loan to Value (LTV) Ratio: Loan to Value, commonly known as LTV is the ratio of your loan amount against the value or purchase price of your used car. Different lenders offer different LTV, which is one of the deciding factors against the loan amount that gets approved. If you are looking for a higher loan amount, opt for a lender offering higher LTV.

Examine all these factors while taking a used car loan. Also, pick the most suitable financing method for buying your car. List out all the advantages and the negatives to ensure your ride brings you a joyful journey ahead. You can check Poonawalla Fincorp Used Car loan offerings which come with an easy to apply loan application process, minimum documentation and attractive interest rated.

We take utmost care to provide information based on internal data and reliable sources. However, this article and associated web pages provide generic information for reference purposes only. Readers must make an informed decision by reviewing the products offered and the terms and conditions. Loan disbursal is at the sole discretion of Poonawalla Fincorp.

*Terms and Conditions apply