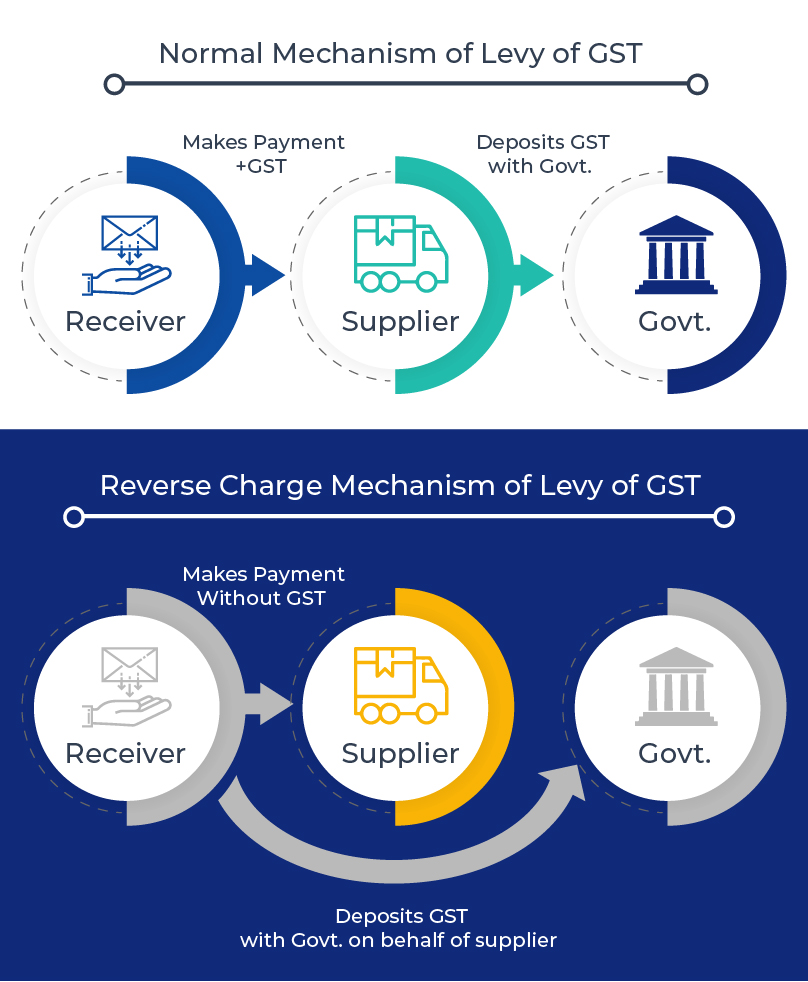

As the goods change hands between a supplier and a recipient, so does the GST that is charged at each taxable transaction. Generally, the supplier is responsible for paying GST. In certain situations, however, the recipient or buyer is responsible for paying taxes under what is known as a reverse charge under GST. In this blog, we will understand the meaning of the reverse charge mechanism in GST and how it works.

What is Reverse Charge Mechanism in GST?

The reverse charge mechanism in GST is a concept where the recipient, rather than the supplier, pays the tax for goods and services. In a regular transaction, the seller of goods or services charges GST on the invoice and pays the same to the government. However, under the reverse charge mechanism for GST, the recipient is responsible for paying GST.

The reverse charge mechanism in GST has been introduced to bring unorganised industries within the tax network. It also helps maintain better compliance and cover sectors where the supplier is outside the country, such as in exports and imports.

Also Read: A Guide to Tax-Saving Options Under Section 80C

When is Reverse Charge Applicable?

Reverse charge under GST is usually regulated under Sections 9(3), 9(4), and 9(5) of the Central GST Act, and similar provisions in the Integrated GST Act. The provisions explain when the liability of payment of GST is transferred from the receiver to the supplier. Reverse charge under GST is generally applied in these cases:

1. Supply of Specified Goods and Services

The list of commodities and services on which a reverse charge under GST is mandatory is notified by the Central Board of Indirect Taxes and Customs (CBIC). Even industries with a high risk of tax evasion or where suppliers are largely unregistered in the tax fold fall under this. A few examples are:

- Unshelled/unpeeled cashew nuts

- Tobacco leaves

- Raw cotton

- Legal services rendered by an advocate to a business firm

- Sponsorship services are offered to a firm or a business organisation

- Services offered by a Goods Transport Agency (GTA)

Suppose a business opts for legal consultancy services from a legal firm. It must pay a reverse charge under GST, and not the firm or the lawyer. Likewise, companies availing GTA services for transportation would need to pay GST themselves under RCM.

2. Supply from Unregistered Dealers to Registered Dealers

Another situation where reverse charge under GST comes into action is when a registered company purchases goods or services from an unregistered vendor. Since unregistered vendors are not entitled to charge GST, the legislation requires the registered buyer to charge GST on their behalf.

- The registered buyer must prepare a self-invoice since the supplier is not permitted to provide an invoice that complies with GST.

- In intra-state buying, the buyer pays CGST + SGST under reverse charge.

- In inter-state buying, the buyer pays IGST under reverse charge.

For example, builders or developers are required to buy at least 80% of their raw materials and goods from registered sellers. However, if this condition is not met, they will be required to pay a reverse charge under GST for the deficiencies. This concept avoids tax leakage from unorganised or small-scale vendors who are not GST registered. It also maintains legality and compliance among registered enterprises.

3. Supply of Services by E-commerce Operators

E-commerce operators play an essential role in the modern economy, and the GST legislation ensures that they also come under reverse charge provisions. Sub-section 9(5) of the CGST Act holds e-commerce operators liable to pay GST for some specified services on their website. Here are some examples:

- Passenger transportation services: Ride-hailing services like Uber and Ola are required to pay GST on behalf of drivers.

- Accommodation services: MakeMyTrip and Oyo need to bear the responsibility of paying GST for accommodation services through their platform.

- Household and related services: Urban Company, which offers carpentry, plumbing, or beauty services, must pay reverse charge under GST.

In e-commerce, the business charges GST from the consumer and pays it to the government rather than depending on small independent service providers. This allows for a more streamlined compliance and makes it simple for small businesses to conduct business without the hassle of GST registration and filing.

Also Read: What is CGST & SGST? Meaning, Differences Explained

Time of Supply under Reverse Charge

Knowing the right "time of supply" is crucial because it will affect when you need to pay the tax.

A. For Goods

Time of supply is the earliest of:

- Date on which goods are received

- Date of payment

- 30 days from the date of invoice received from the supplier

Where none of these are applicable, the date of entry in the accounting ledgers is considered.

B. For Services

Time of supply is the earliest of:

- Date of payment

- 60 days from the date of the invoice

- Date of invoice issued by the recipient

If none of these apply, the date of entry in the recipient's books is treated as the time of supply. This provision prevents GST payment delays under reverse charges and penalties.

Registration Rules under Reverse Charge

According to Section 24 of the CGST Act, any person liable to pay tax under reverse charge under GST must compulsorily register under GST. The default exemption limits of ₹20 lakh or ₹40 lakh do not apply here. (except ₹10 lakhs to special category states, like J&K)

Therefore, even if you're a small business that doesn't need to register for normal GST, you will need to register your company if it falls under reverse charge liability. A supplier is not allowed to apply for ITC or GST paid on goods or services.

Also Read: What Is a Two-Tier Tax Structure? A Simple Guide for Everyone

Who Should Pay GST under Reverse Charge?

The receiver of goods or services is required to pay GST under reverse charge. The supplier must also specify in the tax invoice whether the tax is to be paid under this mechanism. Here are some key points to keep in mind:

- You can claim the GST paid under reverse charge as Input Tax Credit (ITC) if it is for business use.

- A composition dealer is not eligible to claim ITC on reverse charge payments.

- Tax under reverse charge always has to be paid in cash and not set off with ITC.

Supplies of Goods Under Reverse Charge Mechanism

Here is a list of supplies that fall under the reverse charge mechanism:

|

Supply of Goods |

Supplier of Goods |

Recipient of Goods |

|

Cashew nuts, not shelled or peeled |

Agriculturist |

Any registered person |

|

Bidi wrapper leaves (tendu) |

Agriculturist |

Any registered person |

|

Tobacco leaves |

Agriculturist |

Any registered person |

|

Silk yarn |

Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn |

Any registered person |

|

Raw cotton |

Agriculturist |

Any registered person |

|

Supply of lottery |

State Government lottery supply, Union Territory or any local authority |

Lottery distributor or selling agent |

|

Used vehicles, seized and confiscated goods, old and used goods, waste and scrap |

Central Government, State Government, Union territory or a local authority |

Any registered person |

Supplies of Services Under Reverse Charge Mechanism

Here is a list of services that fall under the reverse charge mechanism:

|

Supply of Goods |

Supplier of Goods |

Recipient of Goods |

|

Any service supplied by any person who is located in a non-taxable territory to any person other than a non-taxable online recipient |

Any person located in a non-taxable territory |

Any person located in the taxable territory other than non-taxable online recipient |

|

GTA Services Goods |

Transport Agency (GTA), which has not paid integrated tax at the rate of 12% |

Any factory, society, co-operative society, registered person, body corporate, partnership firm, casual taxable person, located in the taxable territory |

|

Legal Services by an advocate |

An individual advocate, including a senior advocate or a firm of advocates |

Any business entity located in the taxable territory |

|

Services supplied by an arbitral tribunal to a business entity |

An arbitral tribunal |

Any business entity located in the taxable territory |

|

Services provided by way of sponsorship to any body corporate or partnership firm |

Any individual |

Any corporate body or partnership firm located in the taxable territory |

Input Tax Credit (ITC) Under Reverse Charge

The main advantage of reverse charge payment under GST is that the recipient can generally claim ITC, if the goods or services are used for business. However, here are some exceptions:

- ITC can be claimed only after tax payment is made in cash

- Self-invoicing needs to be done to reflect the transaction

- Any undue delay in the issuance of an invoice will invite liability for interest as well as a penalty

Also Read: GST Reduction on Bikes in India 2025: How It Could Affect Your Loan Plan

Compliance Requirements under Reverse Charge

Businesses must follow specific reverse charge compliance processes under GST:

- Self-invoice the purchases made from non-registered vendors.

- Always pay tax in cash, and not in ITC.

- Keep proper records of reverse charge transactions.

- File proper GST returns to report reverse charge liabilities.

Non-compliance can attract interest and penalties, so businesses need to stay up to date with GST notifications.

Conclusion

The Goods and Services Tax (GST) has made indirect taxation easier, but it has also introduced new concepts that every company must pay attention to. Of these, the most important is the reverse charge under GST. Reverse charge under GST is an important mechanism that transfers the tax burden from the supplier to the recipient in certain situations. It not only enhances tax compliance but also revenue collection.

FAQs

Do I need to issue a self-invoice under reverse charge?

Yes, if you purchase from an unregistered supplier, you must create a self-invoice to comply with GST rules.

Can I use Input Tax Credit (ITC) to pay reverse charge liability?

No, reverse charge tax must be paid in cash first, but ITC can be claimed later, if eligible.

Is GST payable under reverse charge refundable if goods are returned?

Yes, you can claim a refund if goods are returned, but proper documentation is necessary.

Does reverse charge apply to imports?

Yes, any import of services or certain goods attracts a reverse charge, with the recipient liable to pay GST.

What happens if I delay payment of GST under reverse charge?

Delayed payment attracts interest and may also lead to penalties under the GST law

We take utmost care to provide information based on internal data and reliable sources. However, this article and associated web pages provide generic information for reference purposes only. Readers must make an informed decision by reviewing the products offered and the terms and conditions. Loan disbursal is at the sole discretion of Poonawalla Fincorp.

*Terms and Conditions apply