For running a successful small and medium business in India, you need more than just patience and dedication. A sound positive cash flow is an integral part to make a business successful. The nature of a small and medium-sized business is such that there are uncertain times that you may have to face. It can be due to an unexpected surge in demand, delayed payments, or increasing expenses. The bottom line is, as an MSME business owner, you need to have the ability to manage overhead expenses to keep the show running.

We always hear about the ability to sell, market, and brand a business being the core competencies that are required to survive in the marketplace, but being effectively able to manage the cash flow is one of the most underrated abilities that can make or break a business.

Gone are the days when you had to depend on the informal sector to meet your fund requirements. You do not need to pay unreal interest rates and depend on unrecognized money lenders to meet your business goals. There are several loan options available to an MSME business owner today.

Here is how you, as an MSME business owner or a young entrepreneur can make use of the loans to manage your overhead expenses.

What is MSME loan?

MSME loan is a type of business loan that is tailor-made keeping in mind the requirements of a small business. The MSME loans can be taken as a business loan for startups, expanding an existing business, Business Loan for women or for any specific requirement in a business. As MSME loans are extended without any collateral and are designed with attractive interest rates, it is a helpful small business loan that can help you in setting up or expanding your business in its early days.

The MSME loans are guaranteed by the government under the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme. This scheme was launched by the Government of India with the Reserve Bank of India and Small Industries Development Bank of India (SIDBI) to promote MSME loans in India. Several financial institutions provide small business loans under this scheme without the need for any land or property ownership to back the loan.

As per the conditions of this scheme, the business owner should give importance to the viability of the project and must fulfil the eligibility criteria as mentioned in the scheme to avail of the benefits.

Advantages of an MSME loan

There are several advantages of an MSME loan in India. The biggest advantage is that you do not need any collateral to take an MSME loan. This is helpful for business owners that are struggling with financial requirements but do not have or do not want to risk their assets for a loan. Several women, especially in rural areas, are starting their own businesses, employing other womenfolk and contributing to the economic development of the concerned micro-economy. In such cases, a Business Loan for women can greatly help, by aiding the MSMEs being run by these women and helping the enterprises gain in scale.

Some of the key advantages of MSME loans in India are as follows:

- Collateral-free

One of the biggest advantages of an MSME loan is that you do not need to risk your business or personal assets to get a loan to expand your business. The loan is extended based on the performance of the company, viability of the project, and profile of the management. More importantly, you do not need any collateral to back the loan application. As MSME loans are designed to help support the small and medium-sized businesses in the country, the fact that you do not need to submit any land or property papers as a security for the loan makes it a great source of funds.

- Flexible

MSME loans to manage overhead expenses are typically taken for a short period. These loans are designed in a manner that their tenure is lower than other loans. This allows you to handle your cashflow challenges quickly and avoid the long cycle of debt.

- Accessibility

The fact that MSMEs have an option to access additional funds to expand their existing business or to enter new territories is a boon for these businesses. Even the process of getting an MSME loan has been simplified by financial institutions and you can get an MSME loan with minimal documentation and in a hassle-free manner. For instance, Poonawalla Fincorp offers business loans for MSMEs following a completely online process. As compared to the scenario a few years ago where MSMEs had to furnish loads of documents to get an MSME loan, the industry has seen a drastic shift in making these loans accessible to these businesses. In addition, several lenders have also started customizing Business Loan for women, making it easier for women-led enterprises to access funds for growth and expansion.

- Reduced interest rates

The rate of interest on any loan is one of the most critical factors that are considered. The MSME loan interest rate is competitive as compared to other categories. Financial institutions charge a processing fee, pre-payment charge, and late fee charges. You should also consider these when taking an MSME loan, along with the interest rate.

How to manage overhead expenses for an MSME in India

The Indian small and medium business owner plays an integral part in nation-building and is a critical component of the Indian economy. According to the India Brand Equity Foundation, Indian MSMEs contribute over 29% to the country’s GDP. With MSMEs being a major contributor to the nation’s economy, it is not surprising that many financial institutions have started to offer loan options to these companies.

Due to the increasing global competition and requirement of continuous innovation, it has been seen that MSME businesses require funds to manage their overhead expenses and to maintain a positive cash flow. The MSME loans can be used for business expansion or to manage your current commitments.

In the traditional business ecosystem, banks were not very eager to extend loans to MSMEs due to the uncertain business cycle and absence of any collateral. However, with the new-age lenders like Poonawalla Fincorp entering the picture, you can today access additional funds quickly, without any collateral, and meet the business requirements. And if you are a woman entrepreneur, there is a tailor-made Business Loan for women to cater to specific requirements.

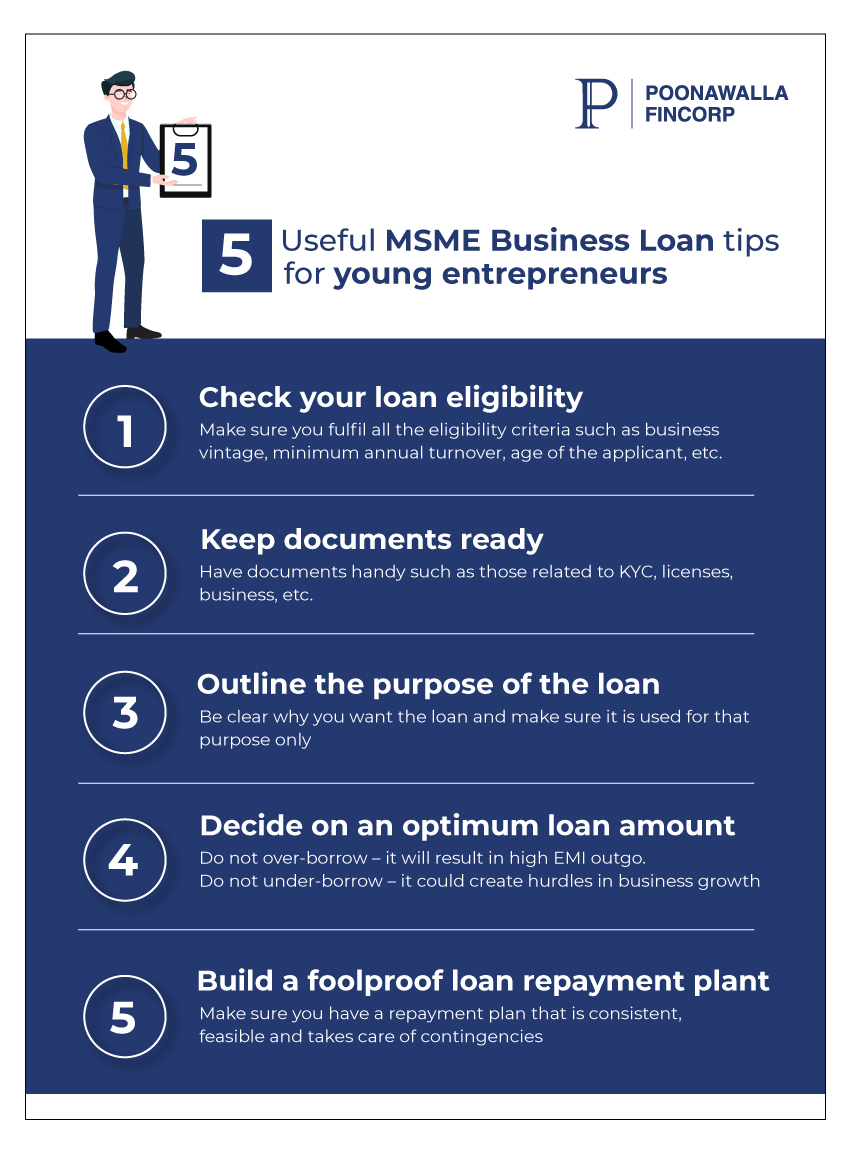

There are a few important tips that you should consider when it comes to taking an MSME loan.

The top 5 loan tips to manage overhead expenses for an MSME and a young entrepreneur in India are as follows:

1. Check your eligibility

You should always do a thorough check on the MSME loan eligibility criteria before applying. You can check the eligibility criteria for an MSME loan on the individual websites of the financial institutions that you are considering. You can also check the third-party platforms where you can compare the eligibility criterion of various companies. It is better to do an eligibility check yourself before applying.

After you apply for an MSME loan, the lender will check your credit score and credit profile. It is not good to have too many inquiries for a credit profile check in a short period. Too many loan inquiries in a short period are considered as a sign of caution for the lenders and may also impact your credit score.

Each lender will have different criteria under the eligibility and the maximum loan amount that you can get. If you check these conditions beforehand, you would only apply with the companies that would meet your requirements. In the case of an MSME loan, there would be conditions like minimum years of operations, minimum turnover, GST returns, location of the business, etc. You should assess all these factors carefully and take a decision for filing applications with a few lenders to get the loan.

2. Check the required documentation

Apart from the eligibility criteria, it is important to check the required documentation with the shortlisted lenders. Even though the list of requirements for paperwork has reduced in the last few years, there are still important papers that would need to be furnished by you. You should check the required documents so that you can match the available documents. In a typical loan application process, the required documentation can be divided into the following categories:

KYC Documents: This would include documents like PAN, Aadhaar, Passport, Voter ID, or any other related document that would help in establishing your identity and serve as proof of your address.

Business documents: As the loan is being taken for your business, you would need to submit documents like Business PAN, income tax returns of the business, rent agreement/utility bills, and bank statements.

Licenses: Some lenders also ask you to submit a copy of the licenses related to your business. For instance, to operate in a food business, you need a license from FSSAI. As the loan being applied for is an MSME loan, lenders also ask for a Udyam Registration certificate. It is a government-issued identification number for small and medium businesses that is issued by the Ministry of MSME.

3. Outline the purpose of the loan

Even before you apply for a loan, it is important to outline the purpose of the loan. This would help you in getting clarity on why you are taking a loan. This would also ensure that you would spend the loan amount towards the objective. In an MSME ecosystem where the business is constantly struggling with fund crunch, a loan would, at times, distract the borrower from the end objective. Most lenders extend loans for business expansion and meeting their day-to-day business needs. However, a business owner needs to be clear about the objective from the start.

For instance, if you took a loan for meeting your overhead expenses but later used the loan amount towards business expansion because of a change of mind, you may face trouble servicing that loan as the working capital challenge has not been resolved. In other words, you should make a plan and stick to it before you apply to get a business loan.

4. Limit your loan requirement

One of the most important tips that will help you in repaying the loan is to limit your loan requirement. It is human psychology to take additional funds at the time of taking a loan. However, it is important to remember that you are expected to repay the loan in a short period with interest. Therefore, you should only take a loan of an amount that is necessary.

If you take funds more than you require, you would not only end up spending them on things that were not necessary but may also face issues at the time of repayment. The higher the loan amount you take, the higher will be the EMI. This step is the most important in your journey to taking an MSME loan.

5. Build a repayment plan

Repayment is one of the most important components in a loan cycle. Any issues in repayment reflect poorly on your credit profile and you may face issues in taking loans in the future.

Therefore, it is important to build a repayment plan and stick to it throughout the loan cycle. While building a repayment plan, it is important to have clarity about the existing expenses that you need to take care of every month and then plan the repayment amount that you can pay back to the lender.

Any default or delay in the payment cycle will impact your credit score and your relationship with the lender. As MSME loans are not backed by any collateral, lenders typically take a business based on the past credit behavior and financial position of the business.

These are some of the important tips that can help you get an MSME loan from a lender of your choice as per your requirement. MSME loans are an excellent option for small and medium-sized business owners to chase their business goals. However, it is better that you do thorough research on the various lenders beforehand rather than filing multiple applications.

Poonawalla Fincorp offers MSME loans at affordable rates with a completely online process that is expected to make your entire experience hassle-free. The easy-to-meet criteria, instant approval and disbursal, zero hidden charges, and flexible tenure options are some of the features that are expected to help you in focusing on growing your business while we take care of the funding requirements.

Poonawalla Fincorp offers Business Loan tailor-made for women to cater to the increasing number of women entering the entrepreneurial space.

FAQs

- What must MSMEs know before applying for a business loan?

- Before applying for a Business Loan, you should know the basic information about the lender. Firstly, you should know the requirements of a Business Loan for MSME:

- Documents required: – Business address proof, identity proof, financial documents, etc.

- Basic Eligibility Criteria for Business Loan: – Age, business vintage, annual turnover, etc.

You can visit our official website to learn more about Poonawalla Fincorp’s Business Loan for MSME.

- Which type of business comes under MSME?

According to the definition provided by the Ministry of Micro, small & medium enterprises, all the businesses are bifurcated as per the investment in plants and machinery or equipment and the company's annual turnover.

- For micro-enterprises – the investment in plants and machinery should not be more than Rs.1 crore, and annual turnover should be less than Rs.5 crore.

- For small enterprises - the investment in plants and machinery should not be more than Rs.10 crore, and annual turnover should be less than Rs.50 crore.

- For Medium - the investment in plants and machinery should not be more than Rs.50 crore, and annual turnover should be less than Rs,250 crore.

- What is MSME loan limit for Poonawalla Fincorp?

With Poonawalla Fincorp’s Business Loan for MSME, you can avail loan up to Rs.50 Lakh.

We take utmost care to provide information based on internal data and reliable sources. However, this article and associated web pages provide generic information for reference purposes only. Readers must make an informed decision by reviewing the products offered and the terms and conditions. Loan disbursal is at the sole discretion of Poonawalla Fincorp.

*Terms and Conditions apply