There are few options for professionals when it comes to taking unsecured debt in the market. A personal loan and a professional loan are the two most favored choices among borrowers. It is important to understand how professional loans score against personal loans so that you can make an informed choice when it comes to deciding between the two.

Several lenders have launched tailor-made loans for professionals like Chartered Accountants, Company Secretaries, or doctors. These are specialized loan products that have been designed keeping in mind the unique requirements of professionals. These are different from a personal loan or a business loan. Like a personal loan is designed for any individual or a business loan is designed for businessmen, a professional loan has been designed after considering the challenges that are faced by professionals.

What is a Personal Loan?

A Personal Loan is an unsecured loan provided by financial institutions to individuals for various personal expenses. Unlike a secured loan that requires collateral, a Personal Loan does not require you to provide any asset. Borrowers can use the funds for the purpose of debt consolidation, medical expenses, home improvements, travel, or other unforeseen financial needs. The loan amount and repayment terms are typically determined based on the borrower’s creditworthiness, income, and financial history. The application process is relatively straightforward, involving documentation and a credit check. Once approved, borrowers receive the loan amount in a lump sum and must repay it in fixed instalments over a specified period.

What is a Professional Loan?

These are the loans specially designed to cater to the unique needs of self-employed professionals, such as Doctors, Company secretaries (CS), and Chartered Accountants (CA). These loans can help professionals manage their business-related expenses, purchase equipment, expand their practice, or meet working capital requirements. Lenders assess the applicant’s profession, qualification, income stability, and credit history to determine loan eligibility and terms. Professional Loans offer competitive interest rates and flexible repayment options to suit the irregular income patterns often associated with self-employment. The loan amount and terms vary based on the borrower’s profile and the lender’s policies.

How Professional Loans Score Over Personal Loans

1. Eligibility

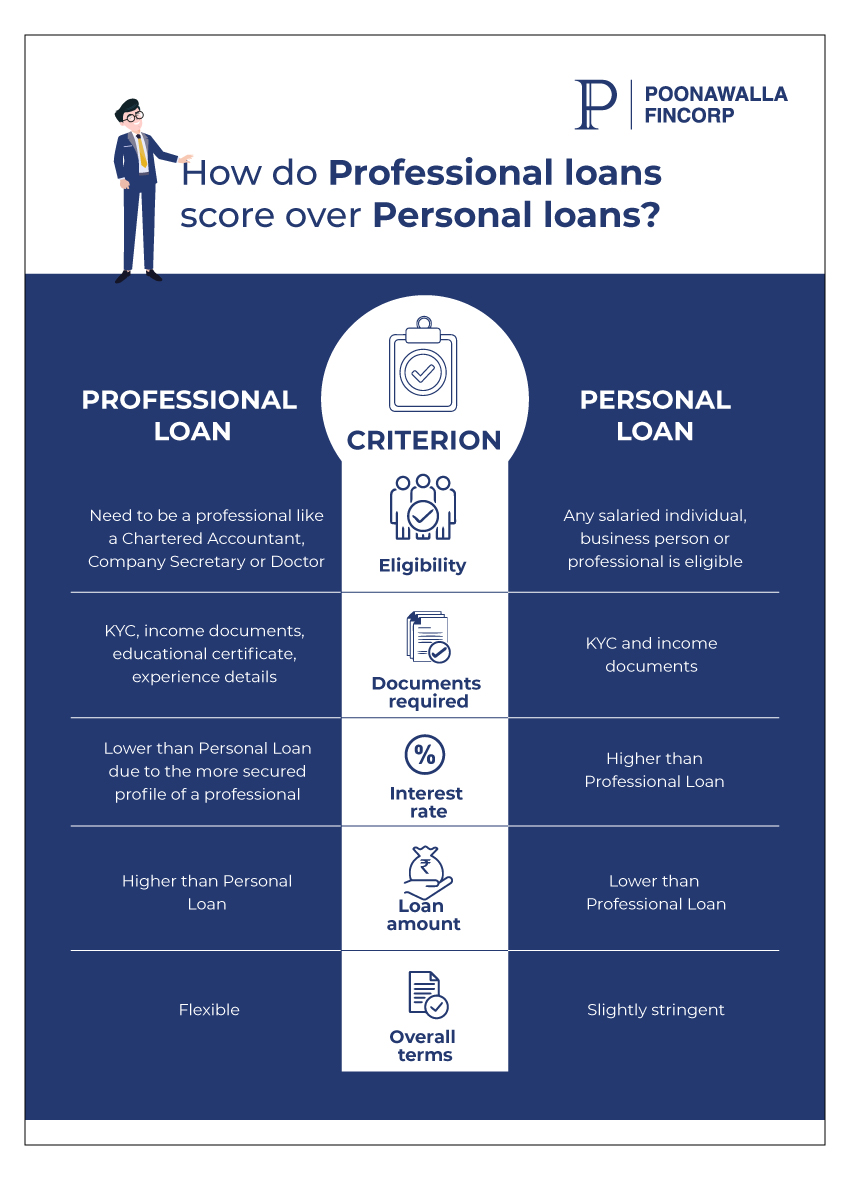

When it comes to eligibility, any salaried, businessman or professional is eligible to take a personal loan. In comparison, you need to be a professional like a Chartered Accountant, Company Secretary, or doctor to take a professional loan. This is the biggest difference when it comes to being eligible for a professional loan as compared to a personal loan.

In other words, a professional can opt for a personal loan but anyone who is not a professional belonging to a certain profession cannot take a professional loan from a lender. There are several benefits like zero prepayment and foreclosure charges and low processing fees in case of a professional loan that makes it an attractive option.

2. Documents Required

The documents required under personal loan and professional loan are not too different from each other. Simply put, you need KYC and income documents for a personal loan and since a professional loan is applicable for professionals working in select professions, you need to submit education and experience details as well.

Both these loan products rely on the income and credit profile of the borrower to grant the loan. You just need to add the documents relating to your education and experience to be eligible for a professional loan.

3. Interest Rate

The interest rate under a professional loan is better as compared to a personal loan. The rate of interest under a professional loan starts from 9.99% per annum while a personal loan interest rate usually starts from 12% per annum. This can be better understood with help of an example.

A professional loan of Rs. 15 lakh for 5 years at a rate of interest of 9.99% per annum will attract an EMI of Rs. 31,863 with a total interest payable during the tenure being Rs. 4.1 lakh. At the same time, a personal loan with the same amount and tenure at 12% interest will increase the EMI amount to Rs. 33,367 and interest amount to Rs. 5.02 lakh.

In other words, if you can get a professional loan you should opt for one as compared to a personal loan. The rate of interest under a professional loan is lower than a personal loan which will help you reduce your EMI amount and interest outgo.

4. Loan amount

The loan amount that you can take under a professional loan is higher as compared to a personal loan. The maximum amount that you can get will depend on the policies of the lender and the profile of the borrower.

All in all, the loan amount that you can get under a professional loan is more than what you can get under a personal loan. If you are looking at a higher loan amount to meet your goals, it is better to opt for a professional loan rather than a personal loan.

Professional loans score high almost on all parameters. Also, lenders usually extend relaxed terms in the case of professional loans. Therefore, it is better to go for a professional loan rather than a personal loan if you are working in specialized professions which can get a professional loan from lenders.

Poonawalla Fincorpextends a loan of up to Rs. 30 lakhto professionals, with zero hidden charges and quick processing. Poonawalla Fincorp understands that professionals lead a busy life. Therefore, we offer complete online processing of loan applications which does not need you to visit any branch or office to submit your application or any paperwork. Apply todayfor a professional loan with Poonawalla Fincorp.

Conclusion

Both Personal Loan and Professional Loan serves different purposes and cater to distinct borrowers’ profile. These loans help individuals and professionals meet their respective requirements, but the eligibility criteria, loan terms, and purposes differ significantly. Hence, borrowers should assess their needs and financial circumstances carefully before opting for the most suitable type for their specific financial situation.

We take utmost care to provide information based on internal data and reliable sources. However, this article and associated web pages provide generic information for reference purposes only. Readers must make an informed decision by reviewing the products offered and the terms and conditions. Loan disbursal is at the sole discretion of Poonawalla Fincorp.

*Terms and Conditions apply