The Coronavirus pandemic has taught us the importance of saving money so that one can address a health or any other personal emergency. During the pandemic, we have seen that the cost can go up significantly not only during treatment of the disease but also for treating post-Covid complications.

Most people think that having a medical insurance is sufficient during such medical emergencies. While health insurance is necessary, in some cases,it is not sufficient,and such people will be forced to run from pillar to post to arrange for the remaining funds.

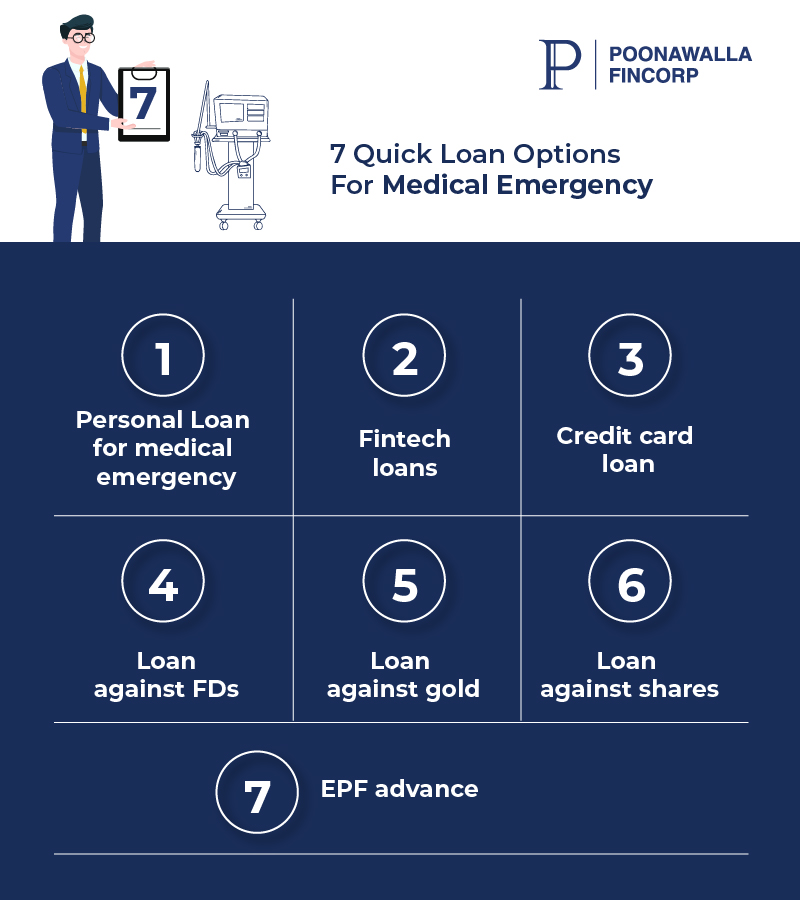

Whether you have insurance or not, if you need emergency funds, the most important thing is to choose a route that allows you to access funds quickly. Here are various loan options for a medical emergency.

1. Personal loan for Medical Emergency

When it comes to our lives or those of our loved ones, we

do not want to leave any stone unturned in ensuring that the best

medical facilities and treatment are provided. However, during

medical emergencies, our financial circumstances often play a key

role in determining the quality of treatment. This is where the personal loan for

medical emergencies comes into play.

A personal loan can help you pay hospital bills along with allied costs during a medical emergency. This may include the cost of hospitalization, medical expenses, rehabilitation, recovery, equipment costs, hospital bills, nursing care, etc.

2. Fintech Loans

Those who find it difficult to get a credit card or bank loan can go to fintech lenders. These businesses often offer loans to those with low credit scores or CIBIL score.

Fintech companies are generally less stringent than major banks and NBFCs when reviewing personal loan applications. These companies may, at times, approve loan applications rejected by major banks and NBFCs due to low credit scores or risky credit profiles. However, given the higher risk of default, fintech usually charge a higher interest rate on loans.

It is advised to choose this funding route only if standard borrowing options do not work for you. When choosing a loan, it is best to compare the interest rate and choose the lender that not only has a low-interest rate but also low or zero prepayment or foreclosure charges, so you can close the loan whenever you have enough funds.

3. Credit Card Loan

For those with a credit card, the quickest way to finance a medical emergency would be to swipe their credit cards and pay off the cost incurred. Paying all the credit card debt by the due date will save you from penalties, late fees, and interest costs, and it will also preserve your credit score.

However if you are not able to make your payments on time, credit card debt can be one of the costliest borrowing options as annual interest rates can range from 25% to more than 50%. Hence, borrowing through credit card must be done with utmost care because there must be enough cash flow with you to pay off the debts and the funds must be available before the repayment period because if the debt is not paid on time, it could lead to higher penalties and interest.

The good part is that a credit card can give you an interest-free credit period up to some days, after which you can repay the amount from your own sources or after receiving a refund from the insurer.

However, if you cannot pay the full amount by the due date, it is best to convert your payments into EMIs. Credit cardholders who cannot pay the full amount on the due date can convert all or part of the bills to interest-free EMIs as per their ability to pay.

In short, for those with a credit card, the quickest way to finance a medical emergency would be to swipe their credit cards and repay the amount by the next due date. Paying all the credit card debt before the due date will save you penalty and interest and will preserve or improve your credit score.

4. Loan Against FDs

In case of a medical emergency, many investors would close their long-term FDs and if they did, they would lose interest and pay early withdrawal fees. Instead, if you have a bank FD locked with a good interest rate, it is best to borrow funds against that FD. Each lender has its own rules regarding how much of the FD-locked amount they can lend and at what cost.

5. Loan Against Gold

Those who cannot get a personal loan for medical emergencies can pledge their gold jewelry or other forms of gold to pay medical bills. Gold loans are mostly issued on the same day.

6. Loan Against Shares

Your investment in stocks, bonds, life insurance policies,etc. can also be used to get a loan. You can go to a bank where you have a long-term relationship to get a loan on these investments by pledging your investments with the bank.

7. EPF Advance

You can get a non-refundable advance on your Employees' Provident Fund (EPF) up to one’s 3-month basic salary or 75% of the total credit balance of your EPF contributions.Earlier EPF used to have a 20-day prepaid delivery window which now has been reduced to 3 daysin recent times, with the use of technology.

Although many experts do not recommend spending your retirement funds in an emergency, if you do not have an alternative, this may be the last resort.

The cost of treatment has increased by leaps and bounds over the past few years. Hence, it is best to keep some liquidity for such unforeseen events, in addition to your medical insurance. However, if these options are not available, or if they are not sufficient, you need to explore other funding options to tide over your requirements. Apply Now for a personal loan for a medical emergency with Poonawalla Fincorp in just a few clicks.

In times of emergency, obtaining money should be a hassle-free affair. We offer flexible payment options for all cosmetic, medical, and dental procedures. With us, you can easily relax knowing that your medical expenses are covered. A Medical Loan will take the weight off your shoulders with competitive interest rates and payment plans designed to suit your needs and get the best treatment for your loved ones or yourself without worrying about medical bills.

We take utmost care to provide information based on internal data and reliable sources. However, this article and associated web pages provide generic information for reference purposes only. Readers must make an informed decision by reviewing the products offered and the terms and conditions. Loan disbursal is at the sole discretion of Poonawalla Fincorp.

*Terms and Conditions apply