A Personal Loan is the best way to meet financial requirements such as weddings, travel, or unexpected costs. In order to ensure a smooth borrowing process, you must understand how the equated monthly instalment (EMI) of the Personal Loan is calculated.

This single component not only affects your monthly budget but also the total interest payable. A Personal Loan EMI calculator proves useful in this regard, as it allows you to quickly and accurately calculate the monthly EMI. In this blog, we will understand why an EMI calculator is important.

What is a Personal Loan EMI Calculator?

Personal Loan EMI calculator is an online tool that allows you to estimate the monthly loan repayment. You enter the principal amount, the interest rate to be charged, and the loan tenure in the calculator.

Once these parameters are entered, the tool calculates the respective EMI, cumulative interest payable, and the total repayment amount. The calculator uses the standard EMI formula to compute results in real time.

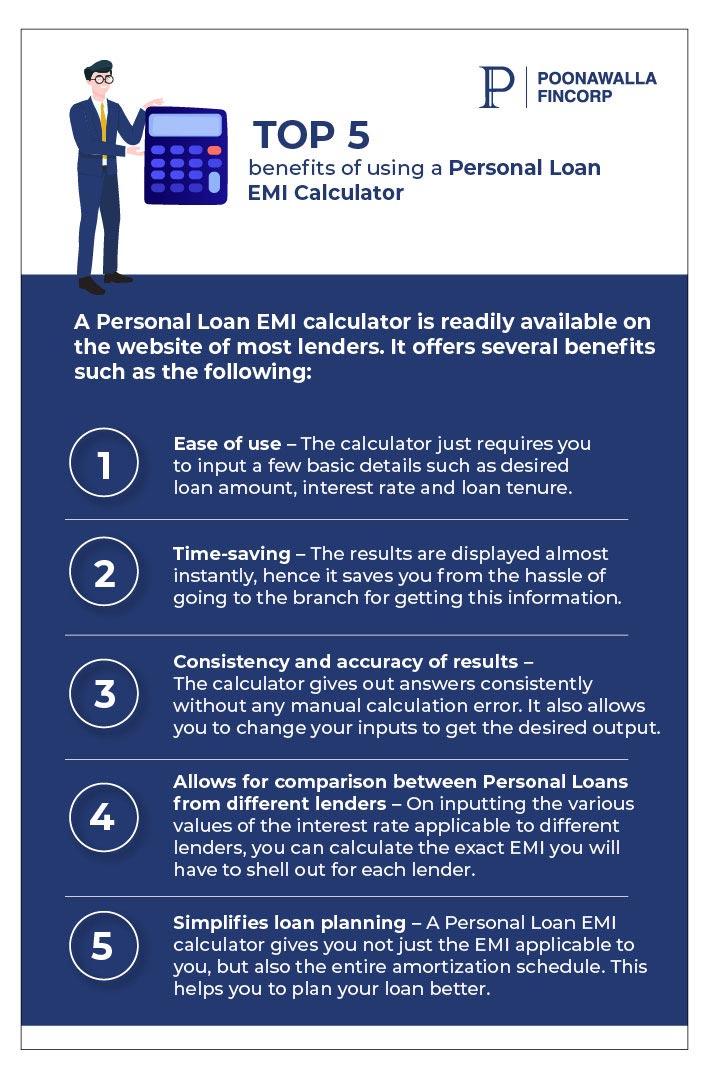

Benefits of Using a Personal Loan EMI Calculator

Here are the key benefits of using a Personal Loan EMI calculator you must know:

1. Better Financial Planning

Knowing your EMI in advance helps you assess your repayment capacity and plan your monthly budget efficiently. You can assess whether the EMI fits comfortably within your monthly income and expenses.

2. Comparison of Loan Offers

With an EMI calculator, you can easily compare different loan offers from various lenders. Even a slight difference in interest rates or loan tenures can significantly impact your EMI, and this tool helps you identify those effects clearly.

3. Saves Time and Reduces Errors

Manual calculations can be time-consuming and are prone to errors. An EMI calculator provides accurate results instantly, saving you valuable time and ensuring you base your decision on correct information.

4. Helps Choose the Right Loan Tenure

The calculator enables you to compare a shorter and longer repayment tenure. You can see how the equated monthly instalment (EMI) changes when you increase the repayment period. This gives you a clear view of the long-term cost and helps you refine your repayment strategy.

5. Useful for Different Loan Types

You can use similar tools such as a home loan EMI calculator, a car loan EMI calculator, or a property loan EMI calculator. These work on the same EMI calculation principle and help you plan different kinds of loans. Whether it is a Personal Loan EMI or a home loan EMI, the method remains the same.

Also Read: How to Plan Your Personal Loan EMI Repayment Better

Steps to Use a Personal Loan EMI Calculator Online

Here are the steps you can follow to use the Personal Loan EMI calculator to estimate the monthly instalment:

Enter the Desired Loan Amount

Enter the desired loan amount that you want to borrow. This could range from ₹1 lakh to ₹50 lakh, based on your needs. The calculator will use this as the principal loan amount.

Select the Interest Rate

Enter the applicable rate of interest. You can adjust this to compare offers or check how interest affects the monthly EMI amount.

Choose the Loan Tenure

Choose the repayment period in months. A longer tenure reduces your monthly EMI but increases total interest. Poonawalla Fincorp offers loan tenures of 12 to 84 months.

After entering all loan details, the calculator will show:

- Monthly EMI

- Total interest payable

- Total repayment amount

The results are calculated instantly and help you finalise your repayment plan with confidence.

Common Mistakes to Avoid When Calculating EMI

EMI calculators are simple to use, but overlooking certain details can lead to incorrect loan assessments. Here are the common mistakes you must avoid:

1. Ignoring Processing Fees and Other Charges

Some lenders charge processing fees, prepayment charges, and other hidden costs. These are not reflected in EMI calculators unless you factor them in manually. Always check the full cost of borrowing before making a borrowing decision.

2. Entering Incorrect Interest Rates

Using the wrong interest rate will negatively affect your emi payable and Equated Monthly Instalment (EMI). Make sure you use the lender's correct rate.

3. Not Considering Floating Interest Rates

If you opt for a floating-rate loan, your EMI may change with market fluctuations. An EMI calculator assumes a fixed rate, so prepare for variations if your loan isn't at a fixed rate.

4. Overlooking Income Fluctuations

Computation of the Equated Monthly Instalment (EMI) based on current income levels without accounting for future changes is a common practice. A financial reserve is wise to meet the crunch or a change in income.

Also Read: Advisory Personal Loan Mistakes That Affect Your CIBIL Score

Why an EMI Calculator is Useful for Budgeting

A Personal Loan calculator helps you understand how much of a loan you can manage comfortably. The tool shows how principal and interest components behave during repayment. It also helps you compare EMIs for top-up loan options or business loans if you plan to borrow in the future.

A loan EMI calculator also highlights whether the EMI fits with other commitments. This keeps your borrowing healthy and prevents overdue payments.

To Conclude

Taking a Personal Loan can be a smart move if done with careful planning. An EMI calculator serves as a guide, helping you understand your repayments clearly before you borrow funds. It empowers you to make better financial choices, like determining how much loan you can afford compare offers, and avoid overstretching your budget. In the world, where financial mistakes may have long-term consequences, it is not only reasonable but essential to use an EMI calculator.

Use the Poonawalla Fincorp Personal Loan EMI Calculator to check your EMI by entering the loan amount, interest rate, and repayment tenure. Remember, a well-informed borrower is a smart borrower.

FAQs

What is the benefit of using an EMI calculator loan tool?

It helps you estimate EMIs instantly and plan your budget before applying for a loan.

Does the EMI calculator show the total interest paid?

Yes. It displays the total interest payable, the EMI amount, and the total repayment.

Can I use the calculator for different loan amounts?

Yes. You can enter various loan amounts to compare EMIs for each option.

Is the EMI calculated instantly?

The tool gives results immediately after you enter the loan amount, interest rate, and tenure.

Does the calculator help with repayment planning?

Yes. It helps you choose a comfortable EMI and select the right repayment period.

We take utmost care to provide information based on internal data and reliable sources. However, this article and associated web pages provide generic information for reference purposes only. Readers must make an informed decision by reviewing the products offered and the terms and conditions. Loan disbursal is at the sole discretion of Poonawalla Fincorp.

*Terms and Conditions apply