What is a Small Personal Loan?

A small personal loan is a short-term, unsecured loan aimed at assisting individuals with urgent or everyday financial needs. A small personal loan, whether used for medical expenditures, education costs, or basic home repairs, provides instant, easy access to funds without the requirement for collateral.

These small loans are popular for their quick processing, minimum paperwork, and flexible repayment terms. It is also a wise and better option than withdrawing money using credit cards. Unlike credit cards, you repay the loan in small EMIs.

Important Features and Benefits of Small Personal Loans

Here are the key features and benefits of Poonawalla Fincorp's small loan:

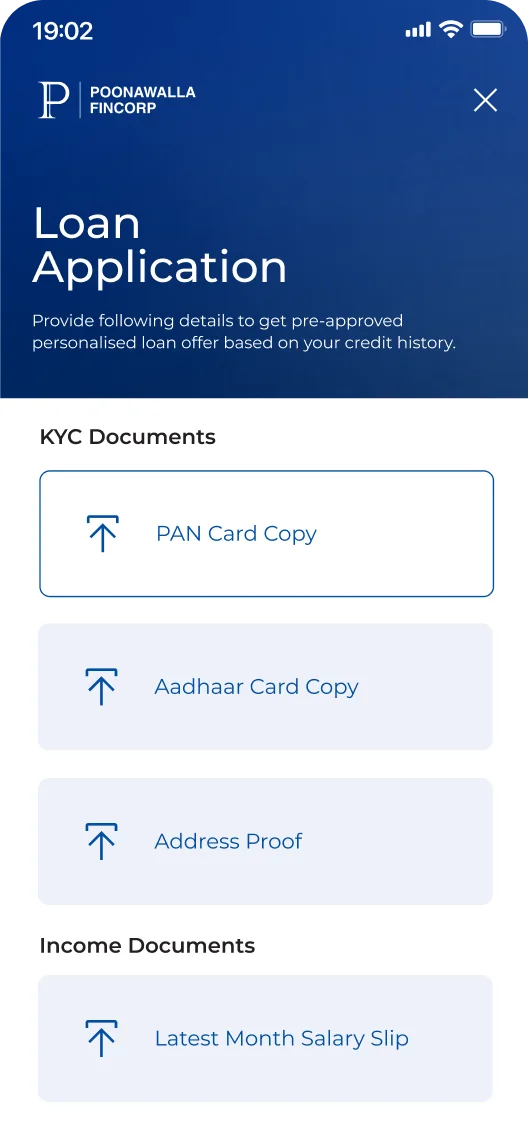

- Minimum Documentation

At Poonawalla Fincorp, our application process requires only a few documents for loan approval, processing and eligibility. These documents include the Aadhaar card and the PAN card as identity proof and a KYC check.

- Collateral-free Loan

Our instant small loan is an unsecured loan that doesn't require any collateral to process the loan. Both the salaried and self-employed individuals can avail of this credit. You can apply for a small loan even with a low credit score.

- Quick Approval and Disbursement

We follow a 100% digital loan application process. As a borrower, you not only enjoy the convenience of quick application process but also the advantage of getting money disbursed within a few minutes. You can apply for a loan amount between ₹50,000 to ₹5 lakhs.

- Transparent Charges & Affordable Interest Rates

At Poonawalla Fincorp, we value transparency and trust above all else. Besides the processing fees, we list down the actual interest rate, foreclosure charges, and other fees. Also, the interest rates charged are affordable, and they can be prepaid without any penalties, based on the repayment period.

- Adjustable Tenure and EMI Options

As the tenure for repayment of your loan is between 12 to 36 months, you can easily make an EMI plan that is suitable for your monthly budget and cash flows. During the time of cash flow challenges, the flexible EMI options help to manage the repayments without straining your finances.

- Perfect for Short-term Objectives

Whether you are a salaried or a self-employed individual, you can flexibly use the loan for purposes ranging from medical bills and home renovation to maintaining the cash flow of your business. Poonawalla Fincorp's small personal loans help to cover the gap without hurting your bank account.

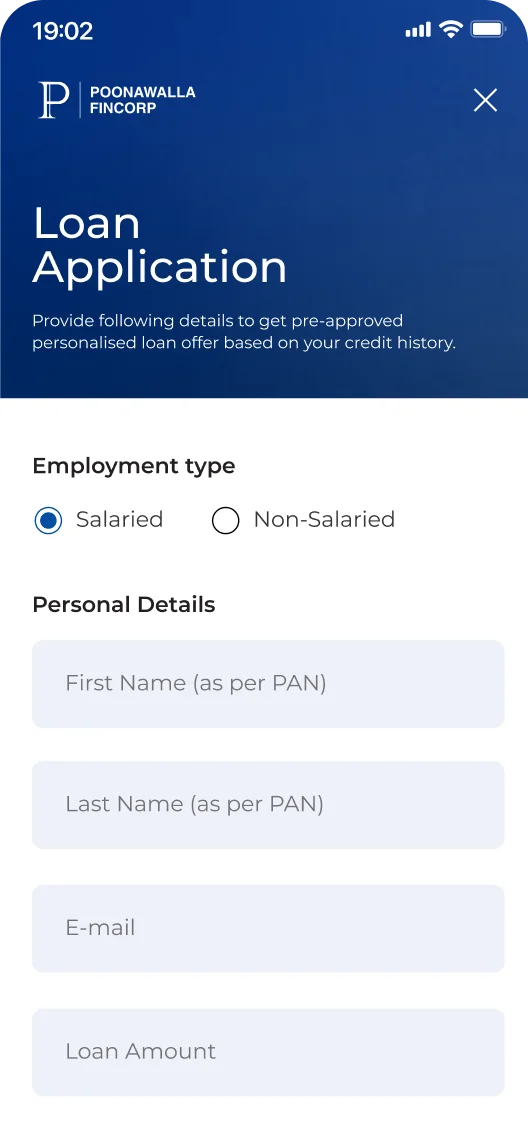

- Online Application

Applying for a small personal loan at Poonawalla Fincorp is easy with the fully digital process. With the help of an online application, the applicant can get quick access to funds with minimum paperwork and real-time status tracking without any need to visit the branch.

Small Personal Loan EMI Calculator

Calculate your monthly repayments using our free EMI calculator. Simply enter the loan amount, interest rate, and tenure to get quick results. Calculate now!

Why Choose Poonawalla Fincorp

How to Apply for an Instant Loan Online in Just 3 Steps

At Poonawalla Fincorp, the eligibility criteria are simple and easy, which allows individuals of various backgrounds and income brackets to apply for these small loans.

- Age: Between 25 and 55 years.

- Citizenship: Indian.

- Annual Income: At least ₹3 Lakh.

In order to get a quick, small personal loan, it is necessary to provide a few essential documents, as mentioned below, for loan approval and disbursal:

- KYC Documents: Aadhaar Card and PAN Card

The loan applicant may also need to submit other documents based on the demand of lender.

We offer small personal loan at competitive interest rates and nominal charges:

2. If Foreclosure or Prepayment is done by balance transfer from another bank/financial institution- 4% on amount being prepaid plus applicable Taxes

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

- Renovating home

- Funding travel plans

- Hosting a wedding

- Buying home appliances

- Covering medical expenses

We look beyond your credit score and financials to ensure eligibility. There are, however, many considerations that may affect the loan disbursal and repayment. Follow these tips for a hassle-free small personal loan:

- Boost your Credit Score

Whether you are a salaried individual or a business owner, a strong credit score shows good credit behaviour and improves the probability of loan approval. Therefore, aim for a credit score higher than 750 by paying off the existing bills on time and keeping credit use low. It not only helps you get a higher loan amount but also a lower interest rate - Fulfil the Eligibility Criteria

Make sure that you fulfil the eligibility criteria, such as age, income, and other factors, to avoid the possibility of rejection of personal loan applications from the lender. - Fill the Application Form Properly

Verify all financial, personal, and employment information entered in the application. Incorrect or conflicting information might cause delays or slow down the process. - Provide all the Necessary Documents

Keep all your important documents, such as income proof and bank statements, handy. Submitting a complete set of documents helps in faster verification and quicker loan disbursal.

Apply for a small personal loan with flexible tenure and low EMIs as per your budget. Apply online for a swift approval based on eligibility and credit score. Whether it's for personal or business needs, you don't need to wait to get funds as a borrower.

You don't have to worry about foreclosure fees or other hidden costs. You can apply for a loan up to ₹5 lakhs at low rates. Contact us today for details and safeguard your financial future.

Happy Customers, Happy Us

I opted for a Loan Against Property balance transfer with Poonawalla Fincorp, and the experience exceeded my expectations. The application process was completely digital, quick, and required minimal paperwork. Getting a significantly lower interest rate helped me reinvest in my business. With better financial flexibility, I was able to scale operations efficiently, leading to a 30% increase in business turnover. Poonawalla Fincorp made the entire journey stress-free, and I highly recommend their services to any business owner looking for smart financial solutions.

Poonawalla Fincorp’s Pre-owned Car Loan made the entire financing process effortless. The loan approval was quick, and the minimal documentation made it even more convenient. Within just a couple of days, the funds were disbursed, allowing me to purchase a well-maintained pre-owned vehicle without any hassle. The repayment options were flexible, and the entire experience was seamless. Thanks to Poonawalla Fincorp, I could get my car without any financial strain. Highly recommended!

Securing a loan to purchase a commercial property with rental income was crucial for my business. Having previously worked with Poonawalla Fincorp, I was confident in their services. The process was incredibly smooth and transparent. The quick disbursement and excellent post-sales support made the entire experience stress-free. Thanks to Poonawalla Fincorp, I now own a prime commercial property in Mumbai, which has significantly boosted my business. Their quick turnaround time and excellent post-sales support made all the difference. I wholeheartedly recommend them to anyone in need.

I had a great experience with Poonawalla Fincorp’s Pre-owned Car Loan. The offered loan amount was as per my expectations, and the entire process was smooth and hassle-free. The documentation was minimal, and the loan was disbursed in just two days! What stood out was the flexibility—repayment was easy, and the EMI structure was well-planned. The loan approval process was straightforward, making it convenient to get the car I wanted without any delays. Overall, the service was excellent, and I highly recommend Poonawalla Fincorp to anyone looking for an easy and quick loan process!

A friend in need, is a friend indeed. Poonawalla fincorp has been like one of those friends for me, who has supported me in my journey. With no hidden charges and no prepayment charges, the company has provided me with the adequate funds I needed for me professional practice. From the loan application process to the disbursal of funds, I did not face any problems. My experience was hassle-free and smooth. Not just me, all my fellow professionals and friends have had a wonderful experience with Poonawalla Fincorp’s Professional Loan.

I am practicing Chartered Accountant (CA) based out of Hubli. There were working capital issues that i was facing like upgrading my firm’s overall infrastructure, hiring well-qualified staff and digitization. Poonawalla fincorp hab been of great support when it comes to funding these requirements. I’ve got one of the best interest rates available in the market, my documentation process was fast & hassle-free. and the digital application process made it very simple to get a Professional Loan as a CA. I recommend to CAs to consider Poonawalla Fincorp for their working capital or any other funding requirements.

I run a chain of farmacy stores with 5 branches in pune. With the growing polpularity of home delivery, my customers were expecting the same from me as well. However, the extra capital requirement made it difficulf for me to hire delivery persons. With Poonawalla fincorp’s Business loan, I am now able to compete with online pharmacy retailers, manage working capital and upgrade my system. My customers have grown 50-60%. The loan applicatipn process is digital, simple and speedy. I was delighted to get my loan amount disbursed quickly, allowing me to upgrade my operationg seamlessly.

Discover More with

Other Loan Options to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

-

personal loan

personal loan -

Frequently Asked Questions

Yes, many banks, non-banking financial institutions (NBFCs) and other lenders use flexible credit evaluation procedures to grant small loans for first-time applicants or those with limited credit history.

Compared to credit card EMIs, a small personal loan has fixed repayment terms, structured EMIs, and is often available at a lower interest rate, which makes it a more reliable and affordable option.

Yes, some lenders enable prepayment or foreclosure after a minimum lock-in term, with no or little fees. Poonawalla Fincorp, for example, offers flexible prepayment terms based on tenure.

Yes, small personal loans are an excellent way to build or improve your credit score if they are repaid responsibly.

Yes, you can, if your payback history is strong, your financial situation allows it, and the ratio of debt to income is within acceptable levels. Lenders will evaluate your capacity to manage both EMIs prior to approval.

You can apply for a small personal loan of up to ₹5 lakhs with Poonawalla Fincorp. The loan amount, however, is based on your credit profile. We also offer the option to borrow a higher loan amount of up to ₹50 lakhs with our standard personal loan.

A low interest rate and long tenure help you reduce your EMIs, whereas a higher rate and shorter tenure increase EMIs, and therefore, your monthly expenses too.

Yes, you can use our personal loan calculator to compare rates, EMIs and different scenarios.