Get a Quick Online MSME Loan for Your Business

MSME loans are designed to help micro and small enterprises meet their financial needs. These loans support business expansion, new ventures, inventory financing, and working capital management.

Poonawalla Fincorp offers MSME loans at competitive interest rates starting at 15% p.a., with flexible repayment terms, minimal documentation, and quick approval. Apply now to access funding that helps grow your business efficiently.

What is an MSME Loan?

An MSME Loan is designed to support small and medium businesses with easy access to funds. These loans come with minimal documentation, quick disbursal, and flexible terms. Whether you need funds for expansion, equipment, or working capital, an MSME business loan helps meet your unique business requirements with ease.

Types of MSME Loan

Different MSMEs have different financial needs. The types of MSME loan options listed below are commonly seen in the market and are available for businesses at present:

1. Working Capital Loans

Working capital loans are used to fund day-to-day operations, including inventory purchases, employee wages, and supplier payments.

2. Term Loans

Term loans are generally considered long-term financing for an expanding business, establishing a new facility, or purchasing a fixed asset.

3. Equipment or Machinery Financing

Equipment and machinery financing is designed to help businesses either purchase new equipment or upgrade their existing equipment.

4. Invoice Financing

Invoice Financing is a method by which a business borrows money against invoices that have not yet been paid.

5. Overdraft Facility

The overdraft facility allows a business to access funds, subject to a pre-approved limit.

Features and Benefits of MSME Loans for Business

MSME loans are tailored to meet the unique financial needs of small and medium enterprises. They offer quick access to funds with minimal hassle, helping businesses grow and stay competitive.

Key Features:

- Unsecured Funding – No collateral required

- Quick Disbursal – Fast processing for timely access to funds

- High Loan Amount – Based on your business needs

- Flexible Repayment – Tenures aligned with your cash flow

- Minimal Documentation – Simple and streamlined application process

Benefits:

- Boost Working Capital – Maintain smooth business operations

- Supports Expansion – Invest in growth, infrastructure, or equipment

- Builds Credit Profile – Improve creditworthiness with timely repayments

- Caters to All MSMEs – Suitable for traders, manufacturers, and service providers

MSME Loan EMI Calculator

Calculate your MSME loan EMIs in advance to ensure smooth cash flow and uninterrupted business operations. Based on your loan amount, interest rate, and tenure, the EMI calculator also shows the total interest payable over the loan period.

Steps to Calculate MSME Loan EMIs

Calculating your MSME loan EMIs is quick and easy. Simply adjust the sliders or enter the required details in the respective fields.

Step 1: Enter the MSME loan amount.

Step 2: Enter the applicable interest rate.

Step 3: Choose your preferred repayment tenure.

Why Choose Poonawalla Fincorp

Apply for MSME Loan Online in Just 3 Steps

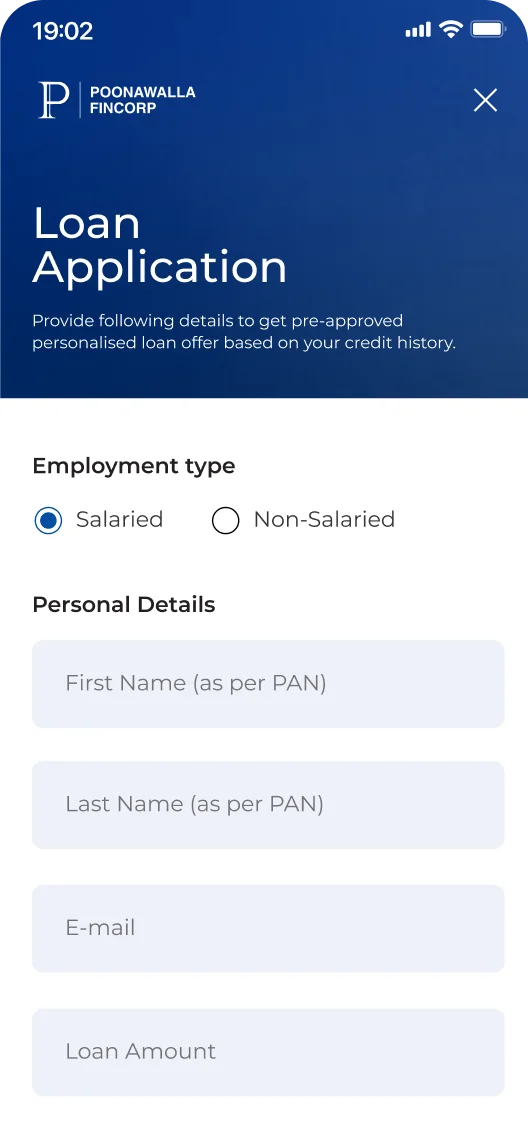

Click on "Apply Now”

Tap the "Apply Now" button to initiate your application.

Enter Details

Enter your DOB, PAN card number, monthly income, and residential details.

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

To qualify for an MSME loan, applicants typically must meet the following criteria.

- Age: Between 24 and 65 years old.

- Citizenship: Indian.

- Annual Turnover: Minimum annual turnover of ₹6 Lakh.

- Business Vintage: At least 2 years.

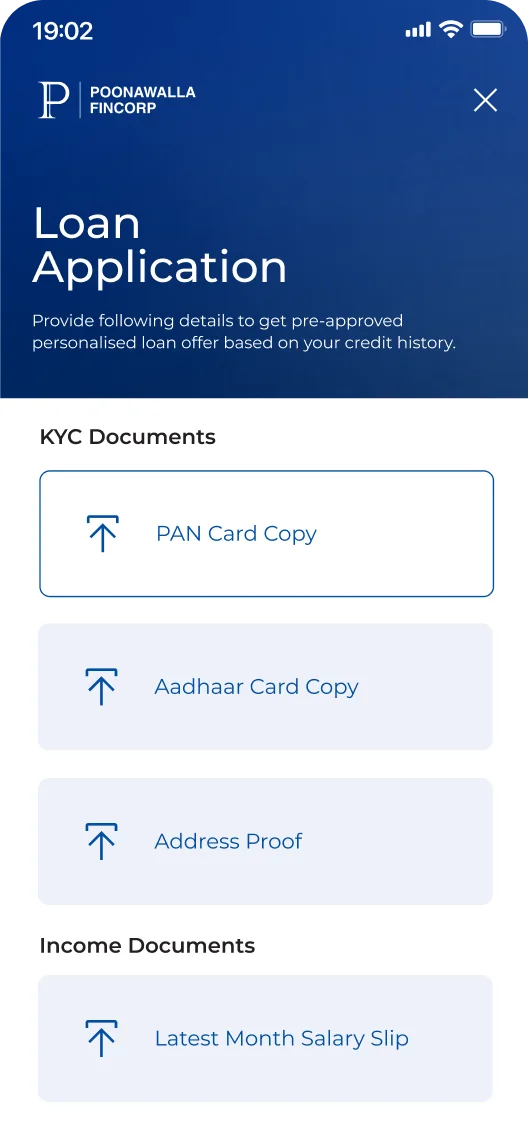

Applying for an MSME loan requires minimal yet essential documentation:

-

KYC Documents

Personal Documents: Proprietor’s/Partner’s/Director’s - PAN Card/Aadhaar Card/Driving License/Voter ID/Passport and officially valid documents + proof of address (If not as per officially valid documents)

Business Documents: Business registration proof + Business address proof (if not as per business registration proof) -

Business Documents

GST certificate, Udyam certificate, and other business-registered documents. -

Financial Documents

Bank statement for the last 6 months or more. Providing accurate documents enables faster processing and higher loan approval chances.

Click to know more about the documentation in detail.

Below are the key interest rates and charges to consider before applying for a loan.

After 6 EMIs: 5% on principal outstanding + taxes

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

- Meet working capital needs

- Purchase machinery and equipment

- Improve existing business infrastructure

- Scale up operations

- Launch a new product

- Consolidate high-interest debt

- MSME (micro, small and medium enterprise)

- A retail shop owner

- Sole proprietorship

- Women entrepreneurs

- Provide proper documentation.

- Build a good credit score

- Consider your repayment capacity

- Provide strong financials

Happy Customers, Happy Us

Business Loan

Securing a business loan marked a pivotal moment for our growth. The funds enabled us to invest in new equipment and significantly expand our operations. The team was transparent, supportive, and guided us every step of the way, making the entire process smooth and reassuring

Business Loan

I never imagined getting a loan could be this easy. With minimal documentation and quick disbursement, the process was incredibly smooth. It came at a crucial time and helped me manage my cash flow effectively.

Business Loan

The business loan gave me the confidence to take on larger projects. With competitive interest rates and flexible repayment terms, the experience was smooth and empowering. Truly a great experience.

Business Loan

Excellent service and timely support! The loan enabled me to renovate my setup and enhance the customer experience. I'm truly grateful for the professionalism and efficiency throughout the process.

Business Loan

The loan helped me stock up inventory just in time for the festive season. Approval was swift, and the team truly understood my business needs. A smooth and supportive experience all around!

Business Loan

I was initially hesitant, but the loan process was so well-managed that I felt confident every step of the way. It enabled me to open a second outlet and expand my brand - an experience that truly exceeded expectations.

Business Loan

The loan allowed me to upgrade my machinery and significantly boost production efficiency. The terms were clear, and the service was handled with utmost professionalism.

Business Loan

I’ve taken loans before, but this was by far the most seamless experience. The team was highly responsive, and the funds played a crucial role in digitising my business operations. Truly a smooth and supportive journey.

Business Loan

The business loan came at just the right time, allowing me to stock up on raw materials and stay ahead of seasonal demand. What impressed me most was the repayment structure; it aligned perfectly with my cash flow, making the entire experience stress-free and sustainable.

Business Loan

Taking the loan was a bold move that transformed my business and boosted revenue. It gave me the financial push I needed to take that leap, and I’m glad I did. The support made a real difference in turning plans into progress.

I run a chain of pharmacy stores with 5 branches in Pune. With the growing popularity of home delivery, my customers were expecting the same from me as well. However, the extra capital requirement made it difficult for me to hire delivery persons. With Poonawalla Fincorp’s Business loan, I am now able to compete with online pharmacy retailers, manage working capital and upgrade my system. My customers have grown 50-60%. The loan application process is digital, simple and speedy. I was delighted to get my loan amount disbursed quickly, allowing me to upgrade my operation seamlessly.

Business Loan

The interest rates were fair and competitive, making it easy to manage cash flow for me. The process was smooth with the service and giving a rating of 10.

Business Loan

I was hesitant at first, but the team explained everything clearly and made me feel confident. The loan helped me manage working capital and grow my business steadily.

Business Loan

I was impressed by how quickly my business loan was processed. The team was extremely helpful and guided me through every step. Thanks to their support, I was able to expand my operations without any hasstle.

Business Loan

The loan process was incredibly smooth, and the team was always available to answer my queries. With the funds, I was able to renovate my store and attract more customers. Truly grateful.

Business Loan

Getting a business loan felt daunting at first, but the entire experience was smooth and transparent. The loan helped me purchase new equipment and increase production. Highly recommend their services!

Business Loan

Excellent service and prompt communication. The loan process was seamless, and the funds were disbursed faster than expected. It’s great to work with professionals who understand business needs.

Business Loan

I needed quick funding to stock up for the festive season, and the business loan came just in time. The Credit Manager was proactive and ensured everything was done on priority. Excellent service!

Business Loan

Thanks to the business loan, I was able to open a second outlet. The team was very supportive and explained all terms clearly. I appreciate the personalized attention I received.

Business Loan

I’ve taken loans before, but this was by far the most professional experience. The documentation was minimal, and the disbursement was fast. I’ll definitely recommend them to fellow entrepreneurs.

Business Loan

The loan helped me bridge a critical cash flow gap during the festive season. The team was approachable and ensured everything was handled efficiently. Great experience!

Business Loan

The business loan helped me hire skilled staff and improved my business. The support from the credit team was outstanding. They understood my business and offered the right solution.

Business Loan

I am very happy with the service of the company and will recommend everyone to take loan from Poonawalla Fincorp.

Business Loan

The loan process was quick and transparent. No hidden charges, and the team guided me at every step. Will recommend everyone.

Business Loan

They didn’t just give me a loan—they gave me peace of mind during a tough time, Happy with the service of Poonawalla Fincorp.

Business Loan

No hidden charges, no surprises. The process was clear and smooth from start to finish.

Business Loan

The team guided me at every step and made the entire experience stress-free, will highly recommend to my friends - rating 10!!!

Business Loan

They tailored the loan to fit my business model. Truly customer-focused and satisfying service given by Poonawalla Fincorp, Highly Recommended!!!

Explore Different Types of Business Loans to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

Frequently Asked Questions

An MSME loan is designed to provide financial support to micro, small, and medium enterprises for their business needs.

Your credit score plays a vital role in the loan approval process. A good credit score (generally above 750) can significantly improve your chances of getting approved and can also lead to more favourable loan terms, such as lower interest rates and longer repayment periods.

Any registered MSMEs, proprietorships, startups, and Self-employed professionals may be eligible to apply for MSME loans.

The majority of MSME loans with Poonawalla Fincorp are unsecured and do not require collateral.

Interest rates are competitive, starting at approximately 15% p.a.

Majorly, KYC documents, proof of business registration, proof of address and financials are required.

Lenders typically get back to customers fairly quickly once the required documentation has been submitted and verified.

Yes, MSME loans can be used for working capital, business expansion, and purchasing new equipment, among other uses.

Yes, Invoice Financing allows you to access funds based on unpaid customer invoices.

The amount of the Loan with Poonawalla Fincorp will depend on your requirement, creditworthiness and the internal assessment.

No; however, registration provides access to additional government benefits and better terms.

MSME loans are specifically designed for Micro, Small, and Medium Enterprises, often with more flexible terms and government support, while business loans are a broader category that includes loans for larger, established businesses.