Get a Quick Business Loan in Odisha

Odisha is the ninth-largest state of India, known for its rich history and famous ancient temples. Its strategic location and business environment offer endless opportunities to entrepreneurs. Whether you need to invest in new machinery, increase your working capital, or renovate your facilities, fulfil any needs with our quick and flexible Business Loan in Odisha. Our loan comes with competitive interest rate, minimal documents, and quick approval. Apply now!

Business Loan EMI Calculator

Use our EMI calculator to estimate your monthly payments. Just enter the loan amount, tenure, and interest rate. Try now!

Why Choose Poonawalla Fincorp

Apply for a Business Loan Online in Just 3 Steps

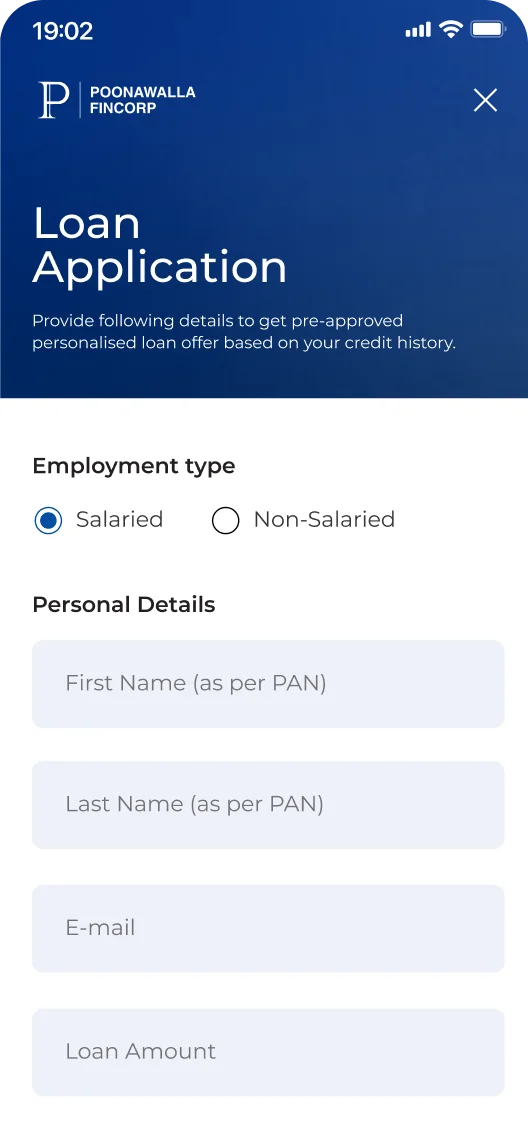

Click on "Apply Now”

Tap the "Apply Now" button to initiate your application.

Enter Details

Enter your DOB, PAN card number, monthly income, and residential details.

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

Meet our simple eligibility criteria to get started on your application today:

- Age: Between 24 and 65 years.

- Citizenship: Indian.

- Business Vintage: At least 2 years.

- Annual Turnover: Minimum of ₹6 Lakh.

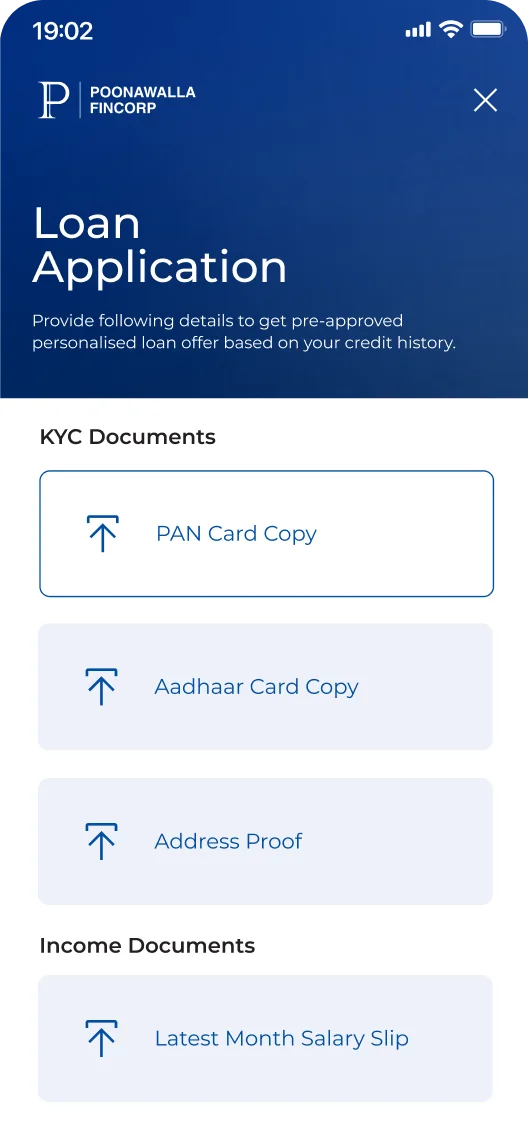

Submit just a few mandatory documents to apply:

- KYC Documents

- Business Address Proof

- Financial Documents

Click to know more about the documentation in detail.

Avail of a Business Loan at attractive interest rate and minimal charges:

After 6 EMIs: 5% on principal outstanding + taxes

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

- Hiring new staff

- Buying new equipment

- Expanding your existing space

- Building working capital reserves

- Consolidating debt

- MSMEs

- Small business owners

- Women entrepreneurs

- Retailers

- Sole proprietors

- Establish a loan purpose

- Have a healthy credit score

- Avoid multiple applications

- Gather required documents beforehand

Poonawalla Fincorp Branch Address in Bhubaneshwar

Address: Office No. 108, 108(a), 109 & 110, 1st Floor, Odyssa Business Centre, Rasulgarh Square, Bhubaneswar, Odisha -751010

Contact Number: 1800-266-3201 (Toll Free)

Timing: 10 am – 6:30 pm (Weekly off on first and second Saturdays and all Sundays.)

Happy Customers, Happy Us

Business Loan

Securing a business loan marked a pivotal moment for our growth. The funds enabled us to invest in new equipment and significantly expand our operations. The team was transparent, supportive, and guided us every step of the way, making the entire process smooth and reassuring

Business Loan

I never imagined getting a loan could be this easy. With minimal documentation and quick disbursement, the process was incredibly smooth. It came at a crucial time and helped me manage my cash flow effectively.

Business Loan

The business loan gave me the confidence to take on larger projects. With competitive interest rates and flexible repayment terms, the experience was smooth and empowering. Truly a great experience.

Business Loan

Excellent service and timely support! The loan enabled me to renovate my setup and enhance the customer experience. I'm truly grateful for the professionalism and efficiency throughout the process.

Business Loan

The loan helped me stock up inventory just in time for the festive season. Approval was swift, and the team truly understood my business needs. A smooth and supportive experience all around!

Business Loan

I was initially hesitant, but the loan process was so well-managed that I felt confident every step of the way. It enabled me to open a second outlet and expand my brand - an experience that truly exceeded expectations.

Business Loan

The loan allowed me to upgrade my machinery and significantly boost production efficiency. The terms were clear, and the service was handled with utmost professionalism.

Business Loan

I’ve taken loans before, but this was by far the most seamless experience. The team was highly responsive, and the funds played a crucial role in digitising my business operations. Truly a smooth and supportive journey.

Business Loan

The business loan came at just the right time, allowing me to stock up on raw materials and stay ahead of seasonal demand. What impressed me most was the repayment structure; it aligned perfectly with my cash flow, making the entire experience stress-free and sustainable.

Business Loan

Taking the loan was a bold move that transformed my business and boosted revenue. It gave me the financial push I needed to take that leap, and I’m glad I did. The support made a real difference in turning plans into progress.

I run a chain of pharmacy stores with 5 branches in Pune. With the growing popularity of home delivery, my customers were expecting the same from me as well. However, the extra capital requirement made it difficult for me to hire delivery persons. With Poonawalla Fincorp’s Business loan, I am now able to compete with online pharmacy retailers, manage working capital and upgrade my system. My customers have grown 50-60%. The loan application process is digital, simple and speedy. I was delighted to get my loan amount disbursed quickly, allowing me to upgrade my operation seamlessly.

Business Loan

The interest rates were fair and competitive, making it easy to manage cash flow for me. The process was smooth with the service and giving a rating of 10.

Business Loan

I was hesitant at first, but the team explained everything clearly and made me feel confident. The loan helped me manage working capital and grow my business steadily.

Business Loan

I was impressed by how quickly my business loan was processed. The team was extremely helpful and guided me through every step. Thanks to their support, I was able to expand my operations without any hasstle.

Business Loan

The loan process was incredibly smooth, and the team was always available to answer my queries. With the funds, I was able to renovate my store and attract more customers. Truly grateful.

Business Loan

Getting a business loan felt daunting at first, but the entire experience was smooth and transparent. The loan helped me purchase new equipment and increase production. Highly recommend their services!

Business Loan

Excellent service and prompt communication. The loan process was seamless, and the funds were disbursed faster than expected. It’s great to work with professionals who understand business needs.

Business Loan

I needed quick funding to stock up for the festive season, and the business loan came just in time. The Credit Manager was proactive and ensured everything was done on priority. Excellent service!

Business Loan

Thanks to the business loan, I was able to open a second outlet. The team was very supportive and explained all terms clearly. I appreciate the personalized attention I received.

Business Loan

I’ve taken loans before, but this was by far the most professional experience. The documentation was minimal, and the disbursement was fast. I’ll definitely recommend them to fellow entrepreneurs.

Business Loan

The loan helped me bridge a critical cash flow gap during the festive season. The team was approachable and ensured everything was handled efficiently. Great experience!

Business Loan

The business loan helped me hire skilled staff and improved my business. The support from the credit team was outstanding. They understood my business and offered the right solution.

Business Loan

I am very happy with the service of the company and will recommend everyone to take loan from Poonawalla Fincorp.

Business Loan

The loan process was quick and transparent. No hidden charges, and the team guided me at every step. Will recommend everyone.

Business Loan

They didn’t just give me a loan—they gave me peace of mind during a tough time, Happy with the service of Poonawalla Fincorp.

Business Loan

No hidden charges, no surprises. The process was clear and smooth from start to finish.

Business Loan

The team guided me at every step and made the entire experience stress-free, will highly recommend to my friends - rating 10!!!

Business Loan

They tailored the loan to fit my business model. Truly customer-focused and satisfying service given by Poonawalla Fincorp, Highly Recommended!!!

Explore Different Types of Business Loans to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

Frequently Asked Questions

Approval of a Business Loan in Odisha takes place within a few minutes, provided you meet the desired eligibility criteria and submit all relevant documents.

Yes, you can avail of a Business Loan from us with no security or collateral. You do not have to pledge any personal or business assets to get our unsecured loan.

To calculate the EMI amount, use our EMI calculator online. By adjusting the loan amount and tenure, you can derive the EMI amount.