Empower Your Professional Growth with Ideal Financing Solution

Take your professional practices to the next level with our hassle-free Professional Loan for Doctors, Chartered Accountants, and Company Secretaries. Renovate your office, enhance your professional skills, buy new equipment, or expand your practice.

Our Professional Loan enables your dreams with affordable interest rates, flexible tenure, fast approval, minimal documentation, and many other benefits. Apply Now!

Why Choose Poonawalla Fincorp

Professional Loan EMI Calculator

Plan your loan repayment easily with our loan EMI calculator. Slide the bars to enter your loan amount, interest rate, and tenure. The calculator will display the EMI amount instantly. Try now!

Apply for a Professional Loan in Just 3 Steps

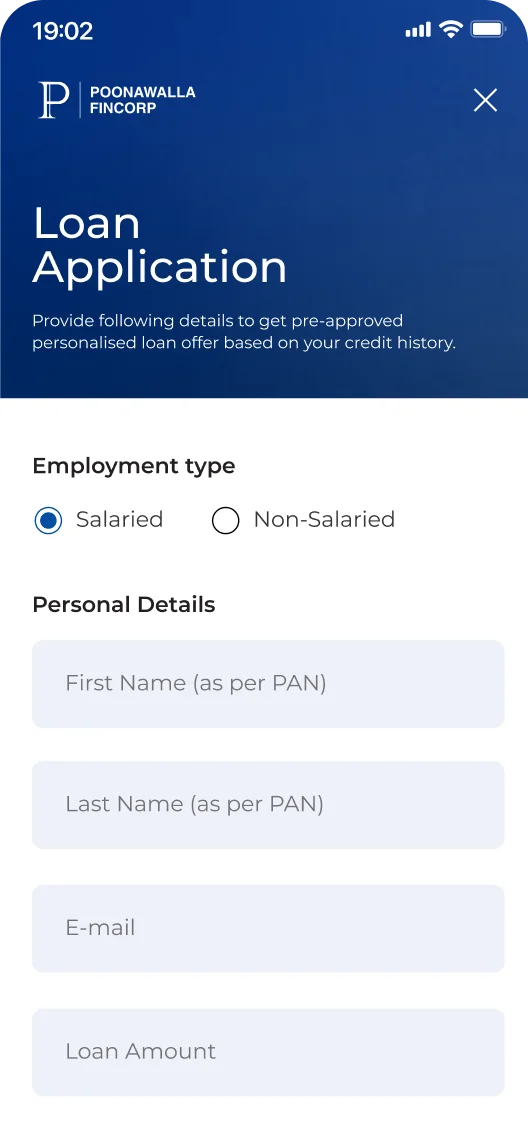

Click on "Apply Now"

Tap the "Apply Now" button to initiate your application.

Enter Details

Enter your DOB, PAN card number, monthly income, and other details.

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

Eligibility Criteria for a Professional Loan

Start your journey to swift and hassle-free loan approval by fulfilling the following eligibility criteria for a Professional Loan:

- Age Between 24 and 65 years.

- Citizenship: Indian.

- Work Experience: Applicant must be a practicing professional for at least 1-year post qualification.

-

Annual Income:

Minimum annual income of ₹3 Lakh.

*Note: The above-mentioned eligibility criteria are indicative. Additional eligibility criteria may be required during loan processing by Poonawalla Fincorp.

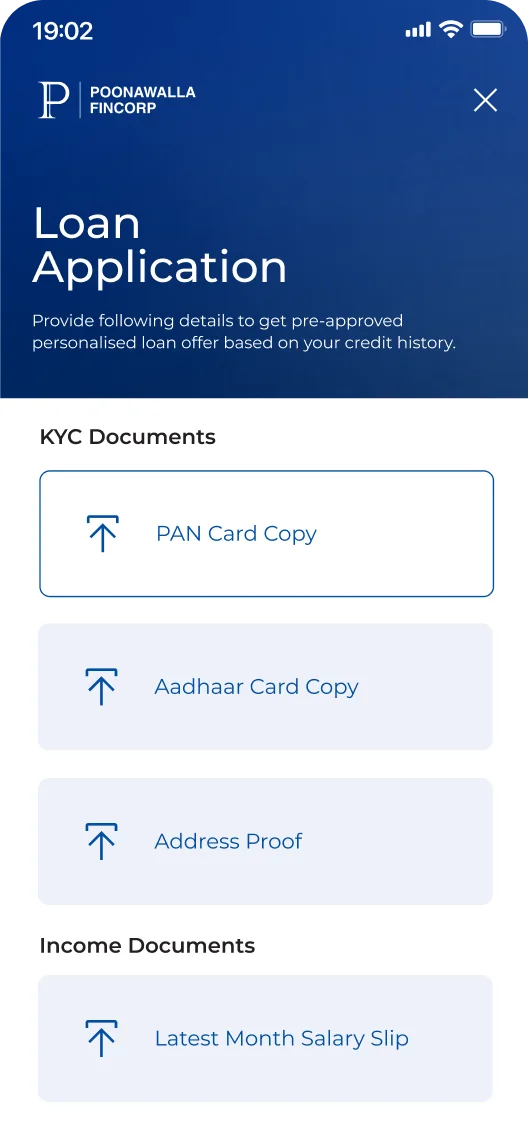

Documents Required for a Professional Loan

Submit the required documents based on whether you are self-employed or working with a firm/company:

- Identity Proof

- Residential Address Proof

- Business Address Proof

- Income Proof

- Bank Account Statement

- Proof of Professional Qualification

Click to know more about the documents required in detail.

Professional Loan Interest Rate and Charges

Save more with our affordable interest rates and charges. Check the below table for interest rate and charges:

After 6 EMIs: 5% on principal outstanding + taxes

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

Types of Professional Loans

· Professional Loan for Self-employed CAs

· Professional Loan for Self-employed CSs

· Professional Loan for Self-employed Doctors

Reasons To Secure a Professional Loan

You can get a Loan to Professionals to:

· Take Your Practice to the Next Level.

· Enhance Your Professional Skills.

· Renovate Your Office Space.

Happy Customers, Happy Us

Professional Loan

A friend in need, is a friend indeed. Poonawalla fincorp has been like one of those friends for me, who has supported me in my journey. With no hidden charges and no prepayment charges, the company has provided me with the adequate funds I needed for me professional practice. From the loan application process to the disbursal of funds, I did not face any problems. My experience was hassle-free and smooth. Not just me, all my fellow professionals and friends have had a wonderful experience with Poonawalla Fincorp’s Professional Loan.

Professional Loan

I am practicing Chartered Accountant (CA) based out of Hubli. There were working capital issues that i was facing like upgrading my firm’s overall infrastructure, hiring well-qualified staff and digitization. Poonawalla Fincorp has been of great support when it comes to funding these requirements. I’ve got one of the best interest rates available in the market, my documentation process was fast & hassle-free. and the digital application process made it very simple to get a Professional Loan as a CA. I recommend to CAs to consider Poonawalla Fincorp for their working capital or any other funding requirements.

Professional Loan

The loan process was seamless from start to finish, and the team consistently went above and beyond to address all my questions with prompt and clear communication.

Professional Loan

I was thoroughly impressed by how swiftly my loan was processed. The team provided exceptional support, guiding me through every step with clarity and care. Thanks to their expertise, I was able to expand my operations confidently.

Professional Loan

The sales team was exceptionally cooperative and addressed all my queries regarding the loan amount, interest rates, and insurance with clarity and patience. Overall, it was a highly positive experience.

Professional Loan

Transparent and hassle-free - there were no hidden charges or unexpected surprises. The entire process was clear, smooth, and straightforward from start to finish.

Professional Loan

I purchased a new commercial vehicle through Poonawalla Fincorp, and the experience was outstanding. The entire process was smooth, quick, and completely hassle-free. The team was incredibly supportive and explained every detail of the loan with full transparency. I’m truly grateful for their guidance and assistance throughout.

Professional Loan

I am happy with the overall loan process and will recommend this company to others colleagues too.

Professional Loan

I am very much satisfied with the services and got quick response with all my queries related to my loan.

Professional Loan

I was guided on every step for my loan journey and process was very smooth

Professional Loan

Sales team was very co-operative and explained resolved all my queries related to loan amount, interest and insurance. Had a very good experience.

Professional Loan

I had a satisfactory experience with Poonawalla. The entire process—from loan application to disbursement—was smooth and well-organized. The staff was cooperative, which made the disbursement quick and stress-free.

Discover More with

Other Loan Options to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

-

professional loan

professional loan -

professional loan

professional loan

Frequently Asked Questions

A Professional Loan is a type of unsecured loan that can be availed by professionals such as chartered accountants (CA), doctors, company secretaries (CS), etc., for fulfilling their financial requirements. It can be used for anything related to their professional practice.

When applying for a loan, you must consider the following points:

- Know how much capital you need.

- Check the Professional Loan interest rates on offer.

- Inquire about the specific eligibility criteria for CS, CA, or Doctors.

- Use the EMI calculator to check EMIs.

Poonawalla Fincorp has simple eligibility criteria, which are:

- Age - Between 24 and 65 years.

- Citizenship - Indian.

- Work Experience - Applicant must be a practicing professional for at least 1-year post qualification.

- Income - Applicant must have a minimum annual income of ₹3 Lakh.

Note: The above-mentioned eligibility criteria are indicative. Additional eligibility criteria may be required during loan processing by Poonawalla Fincorp.

You need to submit the following documents for Professional Loan:

- KYC Documents - PAN card/Aadhaar card/Driving license/Voter ID/Passport

- Financial Documents - Bank account statement for the last 6 months.

- Qualification Documents - Certificate of Practice and Degree Certificate.

*Note: This list of documents required is indicative. The lender may ask for additional documents in cases where greater scrutiny is required.

The interest rate for loans to professionals from Poonawalla Fincorp starts at 13%* p.a. Apart from this, there is also a nominal processing fee of up to 3% of the sanctioned amount.

Here are the benefits of applying for a Professional Loan online:

- You can apply for a Professional Loan online from anywhere at a date and time of your choice and at your convenience.

- It eliminates the need to visit a branch in person. If you are not able to visit the branch for any reason, applying online is the right option for you.

- It is not necessary to carry the documents physically with you. You can simply submit these online and get quick approval.

Our Professional Loan in India for doctors is a specialized and customized offering. With our loan, you can enjoy several benefits, such as competitive interest rates, zero hidden charges, simplified online loan processes with minimal documentation, etc.

While availing of this loan, you should remember your financial needs, purpose for taking the loan, and terms and conditions of the loan.