Get a Professional Loan for Company Secretaries

Accessing instant credit financing without pledging any collateral can help you scale up your practice as a self-employed Company Secretary and manage your daily operations. Take your career forward with a Professional Loan for Company Secretaries from Poonawalla Fincorp. Get a collateral-free loan of up to ₹75 Lakh with instant disbursal. Enjoy our attractive interest rates, no hidden charges, minimal paperwork and swift approval. Apply now!

Professional Loan EMI Calculator

Make use of our online EMI calculator to plan your monthly repayments. Just enter the loan amount, tenure and interest rate to know your EMIs. Try now!

Why Choose Poonawalla Fincorp

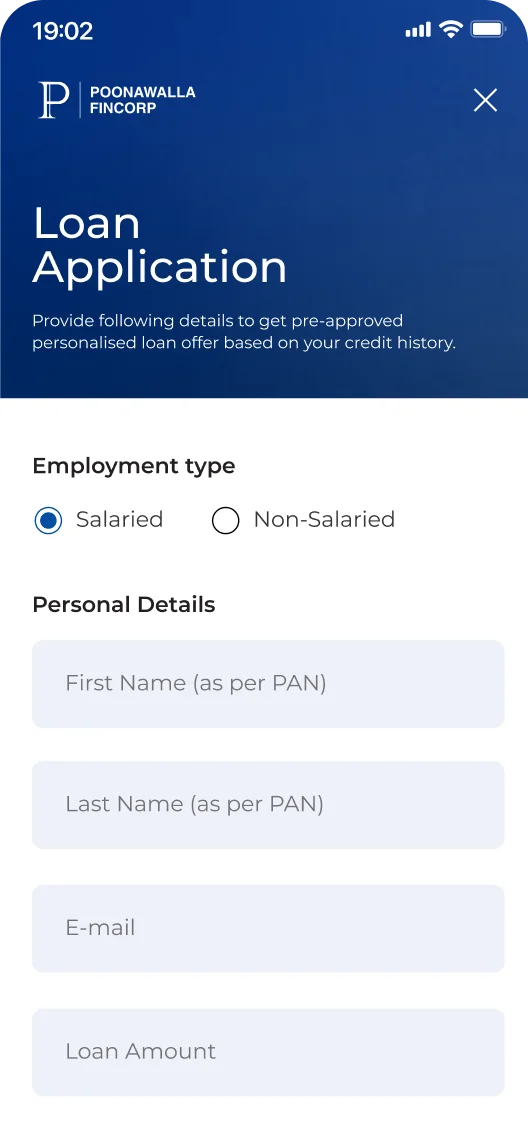

Apply for a Professional Loan in Just 3 Steps

Enter Details

Enter your DOB, PAN card number, monthly income, and other details.

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

Qualify for Poonawalla Fincorp’s Professional Loan for CS by meeting our simple eligibility criteria:

- Age: Between 24 and 65 years.

- Citizenship: Indian.

- Work Experience: Must be practising for at least 1 year post qualification.

- Annual Income: Minimum ₹3 Lakh.

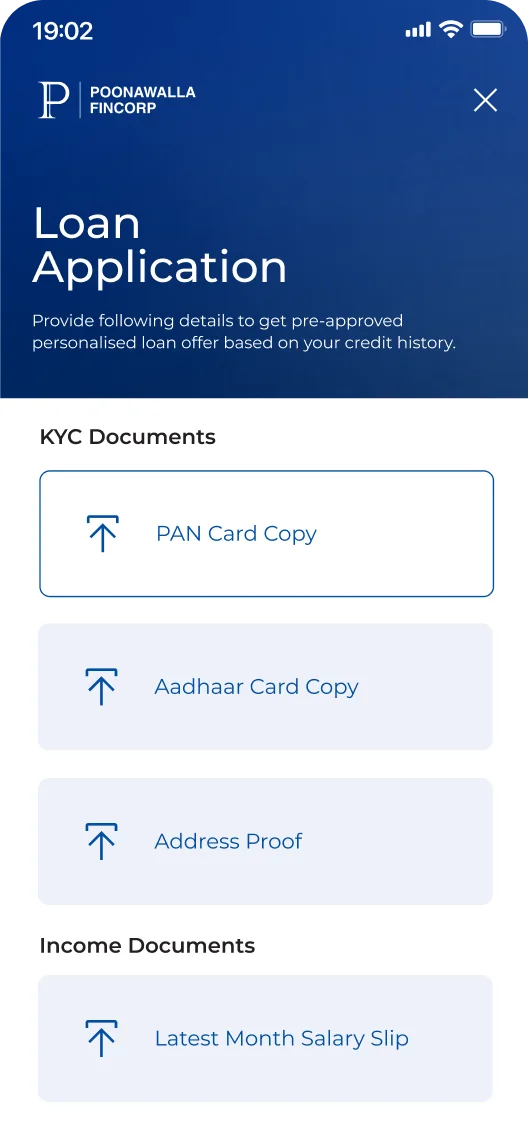

Submit just a few documents to avail of the loan:

- Identity Proof

- Residential Address Proof

- Business Address Proof

- Income Proof

- Bank Account Statement

- Proof of Professional Qualification

Click to know more about the necessary documents in detail.

Get our loan to professionals at competitive interest rate and nominal charges:

After 6 EMIs: 5% on principal outstanding + taxes

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

- Expanding your professional practice

- Meeting working capital requirements

- Enhancing your professional skills

- Consolidation of existing debts

- Recruiting new employees

- Borrow only what you need

- Meet the eligibility criteria

- Check your credit score

- Reduce your credit utilisation ratio to 30%

- Keep the loan documents handy

- Avoid multiple loan applications

Happy Customers, Happy Us

Professional Loan

A friend in need, is a friend indeed. Poonawalla fincorp has been like one of those friends for me, who has supported me in my journey. With no hidden charges and no prepayment charges, the company has provided me with the adequate funds I needed for me professional practice. From the loan application process to the disbursal of funds, I did not face any problems. My experience was hassle-free and smooth. Not just me, all my fellow professionals and friends have had a wonderful experience with Poonawalla Fincorp’s Professional Loan.

Professional Loan

I am practicing Chartered Accountant (CA) based out of Hubli. There were working capital issues that i was facing like upgrading my firm’s overall infrastructure, hiring well-qualified staff and digitization. Poonawalla Fincorp has been of great support when it comes to funding these requirements. I’ve got one of the best interest rates available in the market, my documentation process was fast & hassle-free. and the digital application process made it very simple to get a Professional Loan as a CA. I recommend to CAs to consider Poonawalla Fincorp for their working capital or any other funding requirements.

Professional Loan

The loan process was seamless from start to finish, and the team consistently went above and beyond to address all my questions with prompt and clear communication.

Professional Loan

I was thoroughly impressed by how swiftly my loan was processed. The team provided exceptional support, guiding me through every step with clarity and care. Thanks to their expertise, I was able to expand my operations confidently.

Professional Loan

The sales team was exceptionally cooperative and addressed all my queries regarding the loan amount, interest rates, and insurance with clarity and patience. Overall, it was a highly positive experience.

Professional Loan

Transparent and hassle-free - there were no hidden charges or unexpected surprises. The entire process was clear, smooth, and straightforward from start to finish.

Professional Loan

I purchased a new commercial vehicle through Poonawalla Fincorp, and the experience was outstanding. The entire process was smooth, quick, and completely hassle-free. The team was incredibly supportive and explained every detail of the loan with full transparency. I’m truly grateful for their guidance and assistance throughout.

Professional Loan

I am happy with the overall loan process and will recommend this company to others colleagues too.

Professional Loan

I am very much satisfied with the services and got quick response with all my queries related to my loan.

Professional Loan

I was guided on every step for my loan journey and process was very smooth

Professional Loan

Sales team was very co-operative and explained resolved all my queries related to loan amount, interest and insurance. Had a very good experience.

Professional Loan

I had a satisfactory experience with Poonawalla. The entire process—from loan application to disbursement—was smooth and well-organized. The staff was cooperative, which made the disbursement quick and stress-free.

Discover More with

Other Loan Options to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

-

professional loan

professional loan -

Frequently Asked Questions

Provide just a few documents to apply for our loan to professionals:

- Identity Proof: PAN Card, Driving License, Aadhaar Card, Passport or Voter ID

- Residence Address Proof: Rent Agreement, Electricity Bill or Passport

- Business Address Proof: Electricity Bill or Rent Agreement

- Firm or Member Card

The annual income required for Poonawalla Fincorp’s loan to professionals is ₹3 Lakh and above. Having a higher annual income improves your eligibility for availing of the loan.

The EMI for your Professional Loan is decided on the basis of interest rate, sanctioned loan amount and loan tenure. You can use our EMI calculator to know the EMIs for your Professional Loan.