Get a Pre-owned Car Loan in Puducherry Instantly

Puducherry, a Union Territory of India located on the southeast coast, is known for its French influence, temples, ashrams and cultural significance. Explore this beautiful place or drive to work in your favourite car with a Pre-owned Car Loan from Poonawalla Fincorp.

Get a loan of up to ₹75 Lakh with minimal paperwork. Enjoy competitive rates, a loan of up to 100% of the car’s value and instant disbursal. Apply now!

Pre-owned Car Loan EMI Calculator

Plan your monthly repayments with our online EMI calculator. Simply enter the loan amount, interest rate and tenure to view the results instantly. Try it now!

Why Choose Poonawalla Fincorp

Apply for a Pre-owned Car Loan in Just 3 Steps

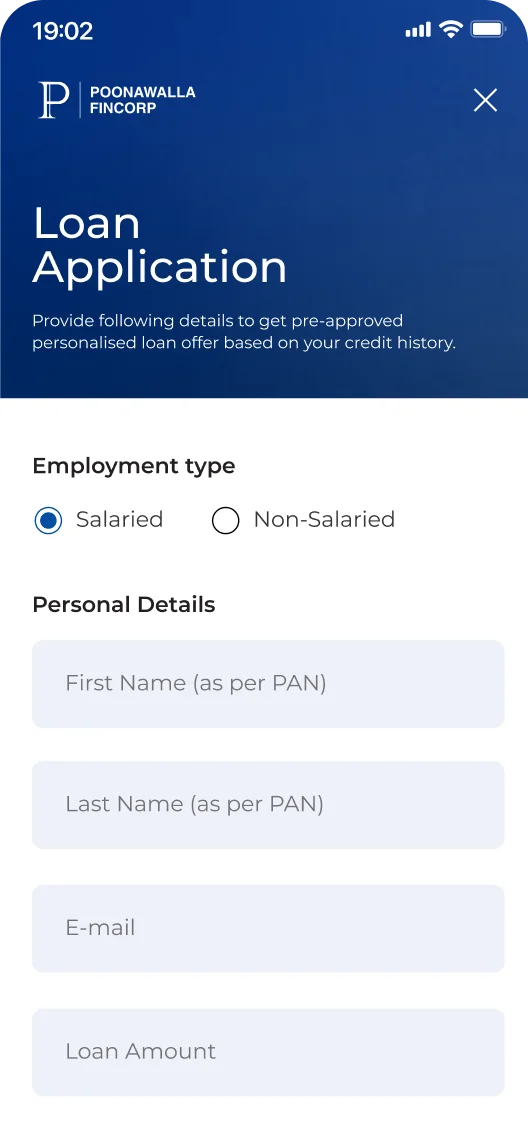

Click on "Apply Now"

Tap the “Apply Now” button to initiate your application.

Enter Details

Enter your DOB, contact, employment and car details.

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

Our eligibility criteria differ depending on whether you are salaried, self-employed or a firm/company and on other aspects like:

- Age

- Citizenship

- Experience/Vintage

- Occupation

Click to know more about our eligibility criteria in detail.

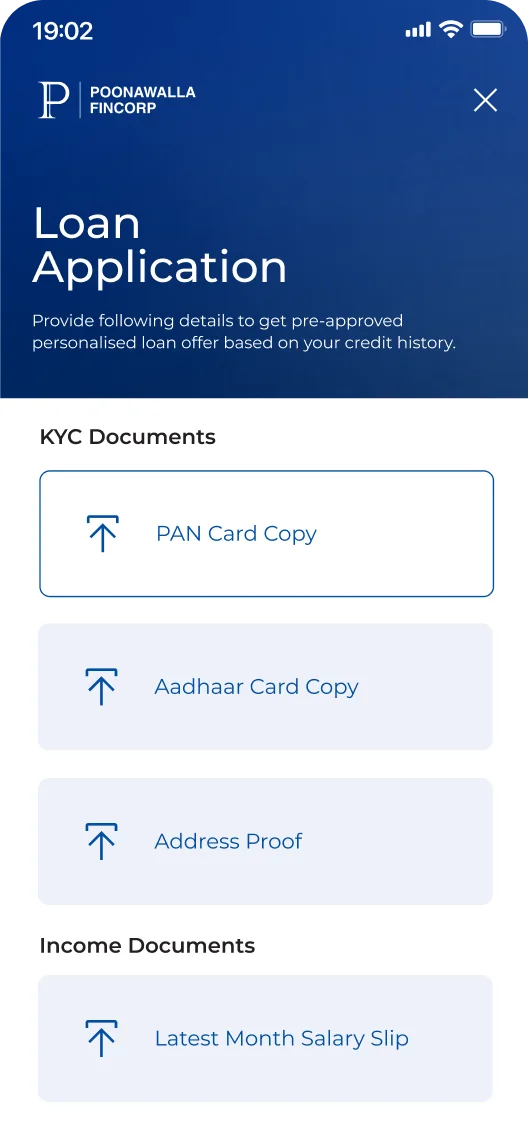

Submit just a few documents to get a used car loan:

- KYC Documents

- Income Proof

- Address Proof

- Car Documents

- Bank Account Statement

Click to know more about the documentation in detail.

Avail of a used car loan at competitive interest rates and nominal charges:

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

- Sedans

- Premium cars

- Hatchbacks

- MPVs

- SUVs

- Electric vehicles

- Firms or Companies

- Salaried Individuals

- Self-employed Professionals

- Check the eligibility criteria

- Decide the loan amount based on your requirements

- Check your credit score

- Keep the required documents ready

- Avoid multiple loan applications

Happy Customers, Happy Us

Poonawalla Fincorp’s Pre-owned Car Loan made the entire financing process effortless. The loan approval was quick, and the minimal documentation made it even more convenient. Within just a couple of days, the funds were disbursed, allowing me to purchase a well-maintained pre-owned vehicle without any hassle. The repayment options were flexible, and the entire experience was seamless. Thanks to Poonawalla Fincorp, I could get my car without any financial strain. Highly recommended!

I had a great experience with Poonawalla Fincorp’s Pre-owned Car Loan. The offered loan amount was as per my expectations, and the entire process was smooth and hassle-free. The documentation was minimal, and the loan was disbursed in just two days! What stood out was the flexibility—repayment was easy, and the EMI structure was well-planned. The loan approval process was straightforward, making it convenient to get the car I wanted without any delays. Overall, the service was excellent, and I highly recommend Poonawalla Fincorp to anyone looking for an easy and quick loan process!

Pre-owned Car Loan

Very professional staff knowledgeable and polite should be always a first choice to choose Poonawalla i always get gentle reminder about my due date and once payment is made love the teamwork thankyou

Thats a smooth process. It helped me getting my query resolved within fraction of seconds.

Pre-owned Car Loan

All Good Services has Provided From Poonawalla Fincorp I will Definitely Recommend the Company.

Pre-owned Car Loan

The service is very good I have received the payment at the time they were given everything is very good.

Pre-owned Car Loan

I will definitely recommend the company if someone ask or need as I have been associated with company from last 10 years

Discover More with

Other Loan Options to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

-

pre owned car loan

pre owned car loan -

pre owned car loan

pre owned car loan

Frequently Asked Questions

You can get a second-hand car loan with lower EMIs by maintaining a credit score of 750 and above, increasing your down payment amount, reducing your debt-to-income ratio, etc.

A self-employed professional should submit:

- Passport

- Voter ID

- Driving License

All salaried individuals, self-employed professionals, firms and companies can apply for our used car loan.