Unlock Your Property's Value With a Loan of ₹60 Lakh

Leverage the value of your property with our ₹60 Lakh Loan Against Property. Access substantial funds to expand your business, cover any financial need, or empower your ambitions.

Our smart financial solution enables you to leverage your asset's value, providing flexibility and security. Avail of Poonawalla Fincorp's Loan Against Property and enjoy competitive interest rates and extended tenure. Apply Now!

EMI Calculator for Loan Against Property

Plan and manage your finances effortlessly with our online EMI calculator. Enter your loan amount, tenure and interest rate to get your EMI amount instantly. Try now!

Why Choose Poonawalla Fincorp

Apply for a Loan Against Property in Just 3 Steps

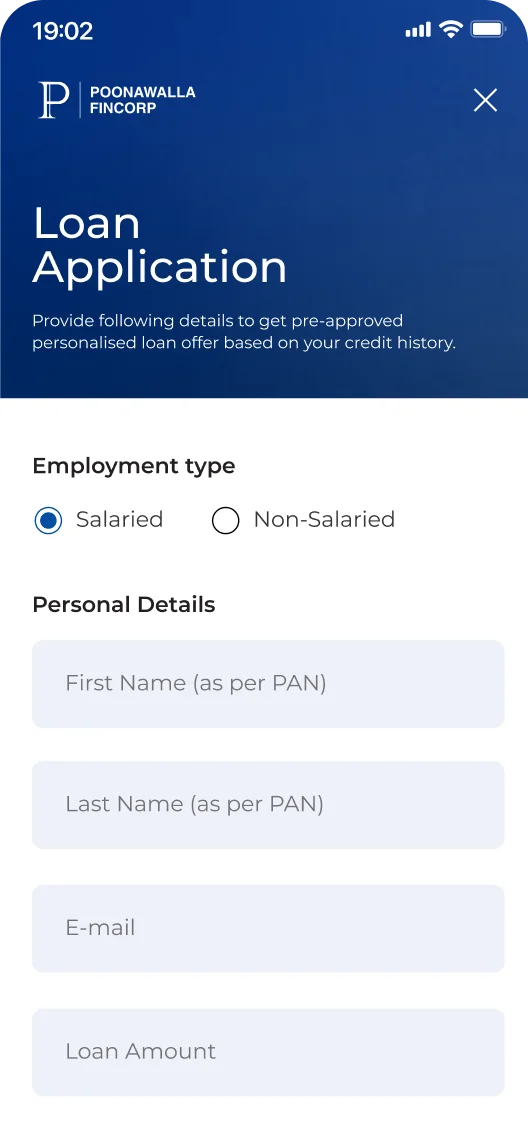

Click on "Apply Now”

Tap the Apply Now button to initiate your application.

Enter Details

Enter your contact, personal, occupation, and property ownership details.

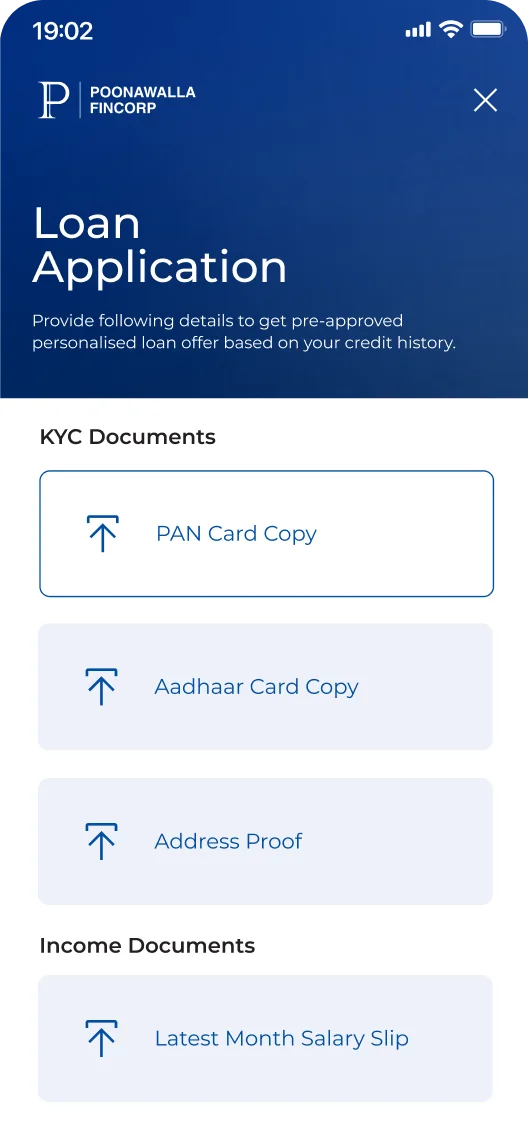

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

Depending upon whether you are salaried, self-employed and firms/companies, your eligibility criteria may differ based on:

- Age

- Occupation

- Experience/Vintage

- Citizenship

Click to know more about eligibility criteria in detail.

Submit the required documents based on whether you are salaried, self-employed or an established firm/company to avail of this loan:

- Property Documents

- Identity Proof

- Address Proof

- Income Proof

- Bank Account Statement

Click to know more about documentation in detail.

Get a loan against your property at competitive interest rates and charges:

Upto 5

Upto 5% on principle partly paid amount plus applicable taxes

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

- Business expansion

- Debt consolidation

- Home renovation

- Medical emergencies

- Overseas education

- Fund a dream wedding

- Salaried individuals

- Self-employed professionals

- Firms or companies

Happy Customers, Happy Us

I am incredibly grateful for the outstanding support I received throughout my loan process. The guidance provided made every step feel manageable and stress-free. What stood out most was the humility and genuine willingness to help at every stage, qualities that made a significant difference in my experience. Without this support, the journey would have been far more challenging. I truly appreciate the dedication and helpful nature that was consistently demonstrated. The efforts put forth were invaluable, and I feel fortunate to have worked with someone so committed and supportive.

Throughout my loan journey, the Poonawalla Fincorp team showcased exceptional dedication, in-depth product knowledge, and a truly customer-centric approach. At every stage, they guided me with patience and clarity, making the entire process seamless, transparent, and timely. Their proactive communication and unwavering willingness to go the extra mile are a testament to the organization’s high standards of service excellence. Such professionalism not only fosters strong customer trust but also reinforces Poonawalla Fincorp’s reputation as a leading, customer-focused financial institution. I extend my heartfelt thanks to the entire team for their commendable efforts and wish them continued success in all their endeavors.

It was really great working with Poonawalla Fincorp. Thanks to the support and coordination by the team. I was able to get a significant portion of my requirements despite having a bit of a mess in my financial records. The loan processing and disbursement process at Poonawalla Fincorp was super smooth. They were incredibly cooperative and helpful. I’m looking forward to building a healthy relationship with them in the future. Thank you.

Discover More with

Other Loan Options to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

-

-

loan against property

loan against property

Frequently Asked Questions

The loan amount you receive against your mortgaged property depends on factors such as the loan-to-value ratio, property type, and eligibility.

The maximum amount you can obtain through our LAP scheme is up to ₹25 Crore.

Our monthly LAP interest rate starts from 9.5% p.a. depending on your property details and personal profile.

Our ₹60 Lakh Loan Against Property has the lowest EMI, at ₹1,044 per lakh for over 180 months.

*T&C Apply