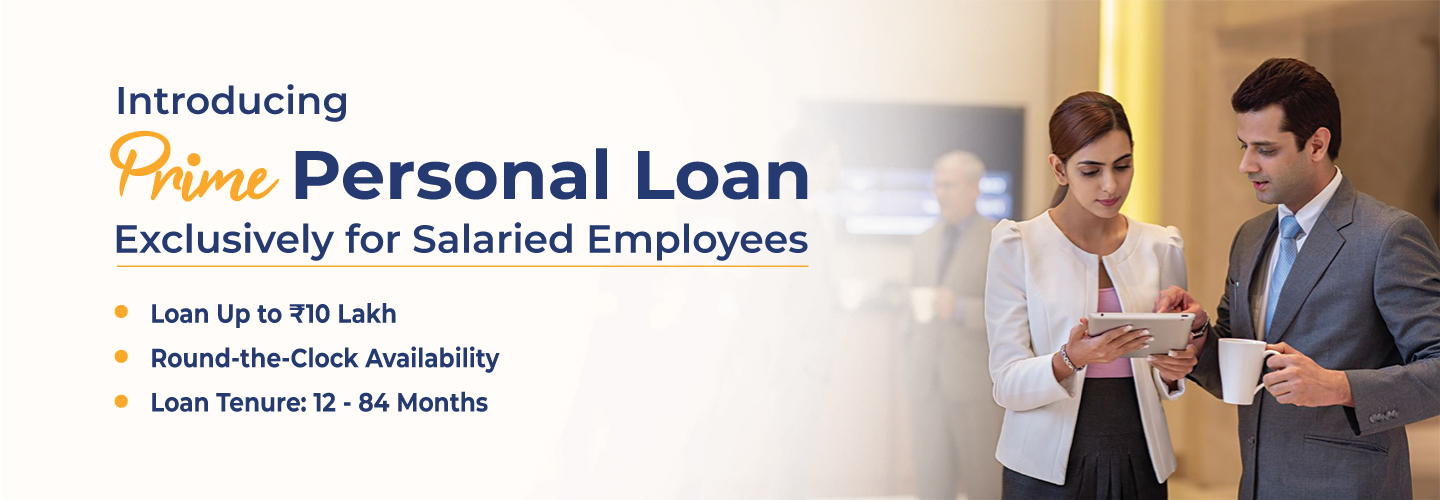

Realise Your Dreams With a Prime Personal Loan for Salaried Employees

Introducing Prime Personal Loan, designed exclusively for salaried employees working with a select few corporates in the country. With an end-to-end digital hassle-free application process and 24*7 availability, Prime Personal Loan also gives you the flexibility to choose longer EMI tenures of up to 84 months*. This exclusive offering from Poonawalla Fincorp comes with a zero collateral requirement and instant disbursal.

Get a loan of up to ₹15 Lakh from Poonawalla Fincorp with minimal paperwork. Benefit from our attractive interest rates and swift approval. Apply now!

Check Your Monthly EMI For Prime Personal Loan

Plan your monthly repayment efficiently with our EMI calculator. Enter the loan amount, interest rate, and loan tenure. Calculate now!

-

EMI Amount = *

Interest Rate and Charges for Prime Personal Loan for Salaried Employees

We offer loans at competitive interest rates and nominal charges:

| Interest Rate | 12.65%* p.a. (fixed) onwards |

| Amount | ₹1 Lakh to ₹15 Lakh |

| Processing Fees | 0.5% to 2% of the sanctioned amount, plus applicable taxes |

| Lowest EMI Per Month | Starting from ₹1,765* per Lakh for 84 months |

| Tenure |

|

| Prepayment/Foreclosure Charges |

|

| Default/Penal Charges | 24% per annum (plus applicable taxes) |

| Repayment Instrument Dishonour Charges | ₹500 per bounce plus applicable taxes |

| Stamp Duty | At actuals (as per state) |

| Hidden Charges | Nil |

Eligibility Criteria for Prime Personal Loan for Salaried Employees

You can check if you meet all the eligibility criteria to apply for the Prime Personal Loan:

Age

Citizenship

Net Monthly Income

Employment

Work Experience

Credit Score

- Age: Between 23 and 58 years.

- Citizenship: Indian

- Net Monthly Income: ₹30,000 and above

- Employment: Full-time employment with a private or public limited company

- Work Experience: Minimum 1 year, with at least 1 month in the current company

- Credit Score: Good credit/bureau score

Documents Required for Prime Personal Loan for Salaried Employees

Submit just a few necessary documents to avail of Poonawalla Fincorp’s Prime Personal Loan:

-

KYC Documents

-

Financial Statements

-

Proof of Employment

- KYC Documents: PAN Card and Aadhaar Card

- Financial Statements: Bank statements for the last 12 months

- Proof of Employment: Verified official email ID (through OTP verification)

Apply for a Prime Personal Loan for Salaried Employees

Click on

"Apply Now”

Click on "Apply Now”

Tap the "Apply Now" button to initiate your application.

Enter

Details

Enter Details

Enter your DOB, PAN card number, monthly income, and residential details.

Upload Documents

Upload Documents

Upload the necessary documents to get quick approval.

Different Uses of a Prime Personal Loan

- Covering travel costs

- Meeting your wedding expenses

- Renovating your home, purchasing furniture and white goods

- Paying emergency medical costs

- Financing your higher education, school fees and college fees

- Purchasing a vehicle

- Hair Transplant & luxury medical expenses

- Debt Consolidation

- Other non-speculative personal expenses

Tips for a Successful Personal Loan Application

- Fulfil the eligibility criteria

- Check your credit score

- Keep your debt-to-income ratio low

- Submit all the necessary documents

- Avoid multiple loan applications

Frequently Asked Questions

You will need a good bureau/credit score to become eligible for our Prime Personal Loan.

No, you need not pledge any collateral or security to apply for our personal loan. Just ensure that you meet the eligibility criteria and submit the necessary documents to get loan approval.

Many factors affect the interest rate for our Prime Personal Loan for Salaried Employees, including your current employer, credit score, work experience, loan amount, monthly income, repayment capacity, etc.

*Terms & Conditions Apply