Get a Personal Loan in Bangalore Online

Bangalore, India’s ‘Silicon Valley’, is a vibrant hub where financial needs can arise as quickly as opportunities. Whether you’re in tech-heavy Whitefield, bustling Koramangala, or peaceful Jayanagar, managing expenses shouldn’t require pledging assets. A collateral-free Personal Loan from Poonawalla Fincorp gives you the financial flexibility you need. Apply online in Bangalore and get quick access to funds for weddings, medical emergencies, education, home renovation, or any personal goal.

Get a collateral-free loan of up to ₹50 lakh with competitive interest rates, minimal documentation, and no restrictions on end-use. Apply now!

Personal Loan EMI Calculator

Calculate your EMIs easily using our online EMI calculator. Just enter the interest rate, loan amount, and tenure to know your monthly repayments. Try now!

Why Choose Poonawalla Fincorp

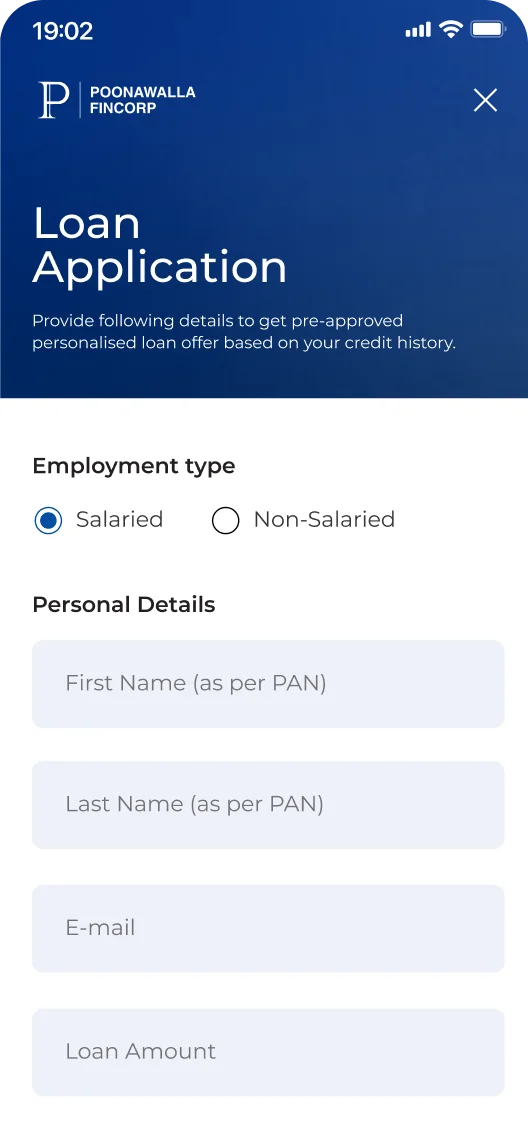

Apply for a Personal Loan Online in Just 3 Steps

Click on “Apply Now”

Tap the “Apply Now”button to initiate your application.

Enter Details

Enter your DOB, PAN card number, monthly income, KYC details and residential details.

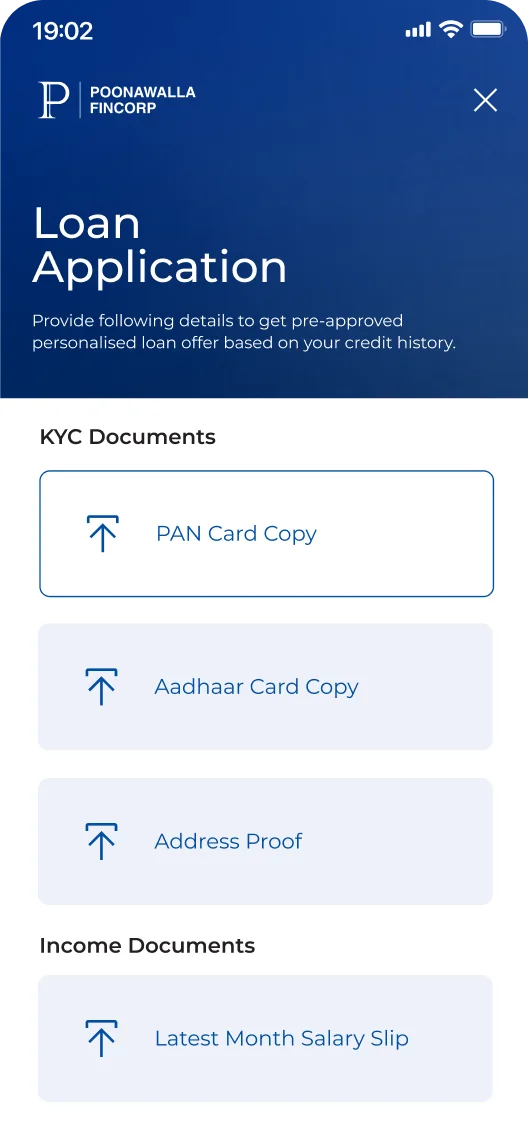

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

Check out the simple Personal Loan eligibility criteria:

- Age: Between 21 and 60 years

- Citizenship: Indian

- Work Experience: At least 1 year of total work experience, 1 month with the current employer

- Employment: Must be employed in an MNC, LLP, private Ltd. company or Central Government entity

- Monthly Income: Minimum monthly salary of ₹30,000

Submit a few necessary documents to apply for a Personal Loan successfully:

- Identify Proof: PAN Card, Voter ID, Aadhaar Card, Passport or Driving License

- Address Proof: Passport, Rent Agreement or Electricity Bill

- Income Proof: Last 1 month’s payslip

- Financial Documents: Last 3 months’ bank account statements

- Proof of Employment: Official mail ID or Employee ID card

Poonawalla Fincorp offers loans for personal use at attractive interest rates and nominal charges:

| Parameter | Details |

| Interest Rate | 9.99%* p.a. onwards |

| Loan Amount | ₹1 lakh to ₹50 lakh |

| Loan Processing Fees | Up to 3% plus applicable taxes |

| Lowest EMI per Month | Starting from ₹2,124* per lakh for 60 months |

| Loan Tenure | 12 to 84 months |

| Prepayment / Foreclosure Charges |

1. Before repayment of first six EMI:

|

| Default Charges | 24% p.a. plus applicable taxes |

| Repayment Instrument Dishonour Charges | ₹500 per bounce plus applicable taxes |

| Stamp Duty | At actuals (as per state) |

| Hidden Charges | Nil |

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

A Personal Loan in Bangalore can help you meet various financial needs without any restrictions on end-use.

- Funding higher education costs: If you wish to pursue an MBA at IIM Bangalore or enrol your child in a top school like Bishop Cotton, a Personal Loan in Bangalore helps cover tuition fees, hostel charges, and study materials without delay.

- Covering medical emergencies: Treatment at Apollo or Manipal Hospital can be expensive. A Personal Loan for medical emergencies ensures you get immediate funds, so healthcare is never compromised.

- Remodelling home: Upgrading your home can transform your living space and bring fresh energy to your daily life. Taking a loan for home renovation helps you upgrade your flat or renovate your home with ease, without straining your budget.

- Consolidating debts: Juggling multiple credit card bills or EMIs can be stressful. Combine them by taking a single loan for debt consolidation with a fixed rate and tenure for easier monthly management.

- Funding a wedding: From grand celebrations at Whitefield resorts to intimate ceremonies in Malleswaram halls, a Personal Loan for marriage helps you manage venue, catering, and décor costs smoothly.

Here are some groups of people who can benefit from a Personal Loan in Bangalore:

- Salaried individuals

- Salaried doctors

- Salaried Company Secretaries

- Salaried Chartered Accountants

- Check Eligibility Criteria: Before applying, confirm you meet the lender’s requirements for age, income, and employment. You can get a quick assessment using a Personal Loan Eligibility Calculator.

- Reduce Your Credit Utilisation Ratio (CUR): Aim to keep your credit card balances below 30% of the total limit. A lower ratio shows responsible credit management and can strengthen your application.

- Keep Documents Ready: Have digital copies of your essential documents prepared, typically KYC (Aadhaar/PAN Card), address proof, and recent salary slips to ensure a fast and smooth online process.

- Fill the Application Accurately: Double-check all details in your application to ensure they match your official documents. This simple step helps prevent unnecessary delays or rejection.

A Personal Loan offers quick, flexible financing for Bangalore residents, with fast approvals and the flexibility to use it as a shopping loan or for other personal needs. Here are some Personal Loan benefits:

- No Collateral Required: A Personal Loan in Bangalore is unsecured, meaning no property, gold, or other assets are required as collateral. This makes it accessible for residents across Bangalore, including HSR Layout, Marathahalli, and Electronic City.

- Quick Processing and Disbursal: Digital processes enable fast approval and quick disbursal for eligible applicants in Bangalore, with funds often credited to the bank account within hours.

- Minimal Documentation: The application requires basic KYC documents such as Aadhaar, PAN, address proof, and income details, with most lenders offering a fully online process.

- Fixed Repayment Terms: Personal loans usually have fixed interest rates and a pre-defined tenure, keeping EMIs constant during the loan period, making monthly budgeting predictable.

- Address 1: 2nd Floor, HM J.C.Road, 36 J.C.Road, Near Minerva Circle, Bangalore-560 002, Karnataka

- Address 2: Ground Floor, Phoenix Citadel, Castle Street, Richmond Town, Bangalore-560025, Karnataka

Contact Number: 1800-266-3201 (Toll Free)

Timing:10 am – 6:30 pm (Weekly off on first and second Saturdays and all Sundays)

Happy Customers, Happy Us

Throughout my loan journey, the Poonawalla Fincorp team showcased exceptional dedication, in-depth product knowledge, and a truly customer-centric approach. At every stage, they guided me with patience and clarity, making the entire process seamless, transparent, and timely. Their proactive communication and unwavering willingness to go the extra mile are a testament to the organization’s high standards of service excellence. Such professionalism not only fosters strong customer trust but also reinforces Poonawalla Fincorp’s reputation as a leading, customer-focused financial institution. I extend my heartfelt thanks to the entire team for their commendable efforts and wish them continued success in all their endeavors.

I am incredibly grateful for the outstanding support I received throughout my loan process. The guidance provided made every step feel manageable and stress-free. What stood out most was the humility and genuine willingness to help at every stage, qualities that made a significant difference in my experience. Without this support, the journey would have been far more challenging. I truly appreciate the dedication and helpful nature that was consistently demonstrated. The efforts put forth were invaluable, and I feel fortunate to have worked with someone so committed and supportive.

It was really great working with Poonawalla Fincorp. Thanks to the support and coordination by the team. I was able to get a significant portion of my requirements despite having a bit of a mess in my financial records. The loan processing and disbursement process at Poonawalla Fincorp was super smooth. They were incredibly cooperative and helpful. I’m looking forward to building a healthy relationship with them in the future. Thank you.

Poonawalla Fincorp’s Pre-owned Car Loan made the entire financing process effortless. The loan approval was quick, and the minimal documentation made it even more convenient. Within just a couple of days, the funds were disbursed, allowing me to purchase a well-maintained pre-owned vehicle without any hassle. The repayment options were flexible, and the entire experience was seamless. Thanks to Poonawalla Fincorp, I could get my car without any financial strain. Highly recommended!

Securing a loan to purchase a commercial property with rental income was crucial for my business. Having previously worked with Poonawalla Fincorp, I was confident in their services. The process was incredibly smooth and transparent. The quick disbursement and excellent post-sales support made the entire experience stress-free. Thanks to Poonawalla Fincorp, I now own a prime commercial property in Mumbai, which has significantly boosted my business. Their quick turnaround time and excellent post-sales support made all the difference. I wholeheartedly recommend them to anyone in need.

I had a great experience with Poonawalla Fincorp’s Pre-owned Car Loan. The offered loan amount was as per my expectations, and the entire process was smooth and hassle-free. The documentation was minimal, and the loan was disbursed in just two days! What stood out was the flexibility—repayment was easy, and the EMI structure was well-planned. The loan approval process was straightforward, making it convenient to get the car I wanted without any delays. Overall, the service was excellent, and I highly recommend Poonawalla Fincorp to anyone looking for an easy and quick loan process!

A friend in need, is a friend indeed. Poonawalla fincorp has been like one of those friends for me, who has supported me in my journey. With no hidden charges and no prepayment charges, the company has provided me with the adequate funds I needed for me professional practice. From the loan application process to the disbursal of funds, I did not face any problems. My experience was hassle-free and smooth. Not just me, all my fellow professionals and friends have had a wonderful experience with Poonawalla Fincorp’s Professional Loan.

I am practicing Chartered Accountant (CA) based out of Hubli. There were working capital issues that i was facing like upgrading my firm’s overall infrastructure, hiring well-qualified staff and digitization. Poonawalla fincorp hab been of great support when it comes to funding these requirements. I’ve got one of the best interest rates available in the market, my documentation process was fast & hassle-free. and the digital application process made it very simple to get a Professional Loan as a CA. I recommend to CAs to consider Poonawalla Fincorp for their working capital or any other funding requirements.

I run a chain of farmacy stores with 5 branches in pune. With the growing polpularity of home delivery, my customers were expecting the same from me as well. However, the extra capital requirement made it difficulf for me to hire delivery persons. With Poonawalla fincorp’s Business loan, I am now able to compete with online pharmacy retailers, manage working capital and upgrade my system. My customers have grown 50-60%. The loan applicatipn process is digital, simple and speedy. I was delighted to get my loan amount disbursed quickly, allowing me to upgrade my operationg seamlessly.

Explore Different Types of Personal Loans to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

-

personal loan

personal loan -

Frequently Asked Questions

You can use a Personal Loan in Bangalore to meet any personal fund requirement, including:

- Home renovation

- Debt consolidation

- Unexpected expenses

- Vacation

- Wedding

A Personal Loan EMI calculator is an online tool that helps you calculate monthly repayments. You just need to enter the loan amount, interest rate, and tenure. You can also try different values and choose the one that fits your monthly budget.

Obtaining a Personal Loan for a low CIBIL score in Bangalore depends on the lender’s specific policies. While a higher score improves eligibility, some lenders may approve your application based on a stable income and employment history. Always check the lender’s criteria before applying.

The quickest method is to apply for an instant Personal Loan in Bangalore through a lender’s official website. Digital applications with minimal documentation are processed rapidly, and eligible applicants in Bangalore can receive funds within a few hours.

To secure the best Personal Loan interest rates in Bangalore, it is advisable to compare offers from various banks and NBFCs. Maintaining a healthy credit score and a stable income can also help you access more favourable rates.

As per RBI guidelines, getting an urgent loan in Bangalore without any documents is not possible. However, reputable lenders offer a digital process that requires minimal documentation, such as KYC and income proof, which can be uploaded online for quick verification.

The process to apply for a Personal Loan online in Bangalore is straightforward. Visit the lender’s website, complete the application form with your details, and upload the required digital documents for verification to complete your application.

Applying directly to a private finance company in Bangalore ensures complete transparency and direct communication regarding loan terms. While Personal Loan agents can offer assistance, a direct online application is often faster and more secure.

Securing a Personal Loan in Bangalore without proof of income is challenging, as lenders must assess your repayment capacity. Most lenders require salary slips or bank statements, though some may consider alternative financial documents depending on their policies.

The best Personal Loan offers in Bangalore vary by lender and depend on your credit score, income stability, and repayment capacity. Compare interest rates, processing fees, and tenure options across lenders before choosing.