Avail of a Loan Against Property in Bangalore

Empower your personal goals in the thriving city with our Loan Against Property (LAP) offers. Be it business expansion, higher education, or unforeseen expenses, availing of our loan is a reliable and efficient way to cover any expenses. Get a high loan amount of up to ₹25 Crore at attractive interest rates with minimal documentation, quick disbursal, and favourable loan terms. Apply now!

Why Choose Poonawalla Fincorp

Loan Against Property EMI Calculator

Plan your monthly repayments effortlessly with our EMI calculator. Enter the loan amount, interest rate, and tenure. Try now!

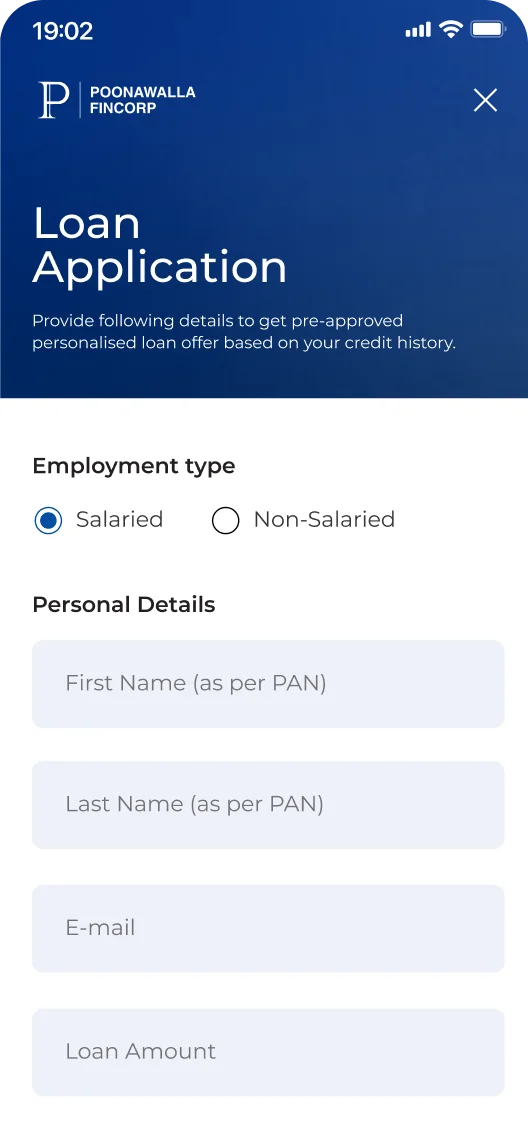

Apply for a Loan Against Property in Just 3 Steps

Click on "Apply Now”

Tap the Apply Now button to initiate your application.

Enter Details

Enter your contact, personal, occupation, and property ownership details.

Upload Documents

Upload the necessary documents for quicker approval.

On successful verification, the loan amount will be disbursed into your bank account instantly.

Eligibility Criteria for Loan Against Property in Bangalore

Depending upon whether you are salaried, self-employed or an established firm/company, your eligibility criteria may differ based on:

- Age

- Occupation

- Experience/Vintage

- Citizenship

Click to know more about eligibility criteria in detail

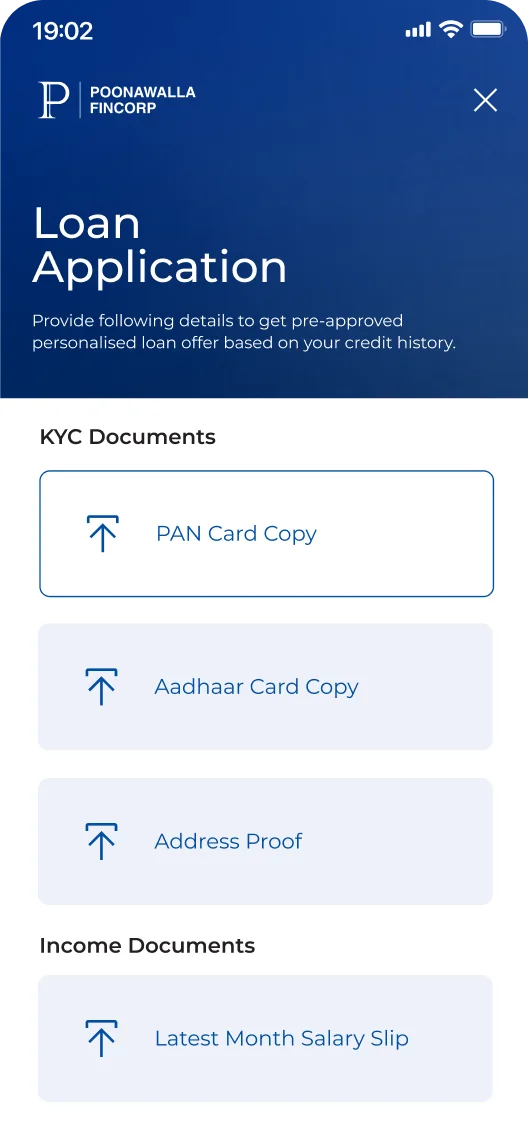

Documents Required for Loan Against Property in Bangalore

Submit the required documents based on whether you are salaried, self-employed or an established firm/company to avail of this loan:

- Property Documents

- Identity Proof

- Address Proof

- Income Proof

- Bank Account Statement

Click to know more about documentation in detail

Interest Rate and Charges for Loan Against Property

Get a loan against your property at competitive interest rate and charges:

5% on principle partly paid amount plus applicable taxes

Default Charges: Penalty will be charged for nonpayment of EMI amount and for non-compliance of material terms and conditions, as more particularly specified at Default Charges.pdf

*T&C Apply

Different Uses of Loan Against Property in Bangalore

- Expanding your existing business

- Improving business set-up

- Medical emergencies

- Paying for higher education

- Home renovation

- Consolidating debt

Who Can Get a Loan Against Property in Bangalore

- Salaried Individuals

- Self-employed professionals

- Companies/ Firms

Poonawalla Fincorp Branch Address in Bangalore

Poonawalla Fincorp Limited

● Address 1

2nd Floor, HM Tower, J. C. Road, Minerva Circle, Bengaluru, Karnataka - 560002

Contact Number: 1800-266-3201 (Toll-Free)

Timing: 10 am – 6:30 pm (Weekly off on first and second Saturdays and all Sundays.)

● Address 2

Ground Floor, Phoenix Citadel, Castle Street, Richmond Town, Bangalore, Karnataka-560025

Contact Number: 1800-266-3201 (Toll-Free)

Timing: 10 am – 6:30 pm (Weekly off on first and second Saturdays and all Sundays.)

*T&C Apply

Happy Customers, Happy Us

I opted for a Loan Against Property balance transfer with Poonawalla Fincorp, and the experience exceeded my expectations. The application process was completely digital, quick, and required minimal paperwork. Getting a significantly lower interest rate helped me reinvest in my business. With better financial flexibility, I was able to scale operations efficiently, leading to a 30% increase in business turnover. Poonawalla Fincorp made the entire journey stress-free, and I highly recommend their services to any business owner looking for smart financial solutions.

Poonawalla Fincorp’s Pre-owned Car Loan made the entire financing process effortless. The loan approval was quick, and the minimal documentation made it even more convenient. Within just a couple of days, the funds were disbursed, allowing me to purchase a well-maintained pre-owned vehicle without any hassle. The repayment options were flexible, and the entire experience was seamless. Thanks to Poonawalla Fincorp, I could get my car without any financial strain. Highly recommended!

Securing a loan to purchase a commercial property with rental income was crucial for my business. Having previously worked with Poonawalla Fincorp, I was confident in their services. The process was incredibly smooth and transparent. The quick disbursement and excellent post-sales support made the entire experience stress-free. Thanks to Poonawalla Fincorp, I now own a prime commercial property in Mumbai, which has significantly boosted my business. Their quick turnaround time and excellent post-sales support made all the difference. I wholeheartedly recommend them to anyone in need.

I had a great experience with Poonawalla Fincorp’s Pre-owned Car Loan. The offered loan amount was as per my expectations, and the entire process was smooth and hassle-free. The documentation was minimal, and the loan was disbursed in just two days! What stood out was the flexibility—repayment was easy, and the EMI structure was well-planned. The loan approval process was straightforward, making it convenient to get the car I wanted without any delays. Overall, the service was excellent, and I highly recommend Poonawalla Fincorp to anyone looking for an easy and quick loan process!

A friend in need, is a friend indeed. Poonawalla fincorp has been like one of those friends for me, who has supported me in my journey. With no hidden charges and no prepayment charges, the company has provided me with the adequate funds I needed for me professional practice. From the loan application process to the disbursal of funds, I did not face any problems. My experience was hassle-free and smooth. Not just me, all my fellow professionals and friends have had a wonderful experience with Poonawalla Fincorp’s Professional Loan.

I am practicing Chartered Accountant (CA) based out of Hubli. There were working capital issues that i was facing like upgrading my firm’s overall infrastructure, hiring well-qualified staff and digitization. Poonawalla fincorp hab been of great support when it comes to funding these requirements. I’ve got one of the best interest rates available in the market, my documentation process was fast & hassle-free. and the digital application process made it very simple to get a Professional Loan as a CA. I recommend to CAs to consider Poonawalla Fincorp for their working capital or any other funding requirements.

I run a chain of farmacy stores with 5 branches in pune. With the growing polpularity of home delivery, my customers were expecting the same from me as well. However, the extra capital requirement made it difficulf for me to hire delivery persons. With Poonawalla fincorp’s Business loan, I am now able to compete with online pharmacy retailers, manage working capital and upgrade my system. My customers have grown 50-60%. The loan applicatipn process is digital, simple and speedy. I was delighted to get my loan amount disbursed quickly, allowing me to upgrade my operationg seamlessly.

Discover More with

Other Loan Options to Suit Your Needs

Get exclusive access to simplified

Personal Finance

Information at

Poonawalla Fincorp’s

FinHub

-

loan against property

loan against property -

loan against property

loan against property

Frequently Asked Questions

The following types of properties are eligible for a loan from Poonawalla Fincorp:

● Residential properties

● Commercial properties

● Industrial properties

● Warehouses

No, our Loan Against Property does not carry any usage restrictions. Only spending not permitted by the regulator is subject to restrictions.

For income proof, owners of companies/firms have to submit the following documents:

● Balance Sheets for two years

● Profit and Loss Statement

● GST Returns

● Income Tax Returns